Modern society is not as irreligious as it claims to be. In fact, today’s most popular religion arguably has more true believers, as the numbers attending its “worship” services reveal, than any other American faith. With its own variety of high-priests, shamans, and bishops, not to mention excommunicated heretics, the new faith feeds on people’s hunger to believe in unbelievable times. While faith in God has waned, a substitute faith, for nature abhors a vacuum, has filled the space. These pseudo-religious political parties, whether in its Democrat or Republican variety, have, over the last one hundred years, eclipsed the older faiths. Today, people no longer go to church and trust in the promised Messiah, but rather go to political rallies and trust in the promises of the latest “political messiah”.

In the Middle Ages, the priest was the divinely commissioned agent and the State merely the divinely tolerated power to enforce God’s rule. Unfortunately, shortly after the Protestant Reformation, Luther’s friend Melanchthon, among others, denied the church had authority to make laws the bound the conscience, claiming only the State had that power. Naturally, the State leaders readily agreed and subsequently seized the moral power from the naive church leaders. The doctrine of the divine right of kings originated from this sequence of events, embodied by kings claiming their power derived not from the Pope, as in earlier days, but instead directly from God himself.

The divine right of kings, in effect, was the king’s declaration of independence from the church’s authority. Interestingly enough, the reformation, although arguably a return to Biblical doctrines, was a mixed blessing. For the various protest disintegrated the Church and integrated the State. This culminated in King James I boldly proclaiming complete independence of the State from church interference. To add insult to injury, the Religious Peace of Augsburg dealt an even more destructive blow to the ancient claim of the church as the universal moral influence within society. Among other things, it was agreed that the citizen of each state must adopt the religion of his sovereign. Cuius regio eius religio. Instead of religious liberty, this was the supreme assertion of State power over society.

Harold MacMillan

Whereas previously one of the roles of the church was to protect society’s members from overzealous kings, the door was now open for the State’s absolute control over morality and law. Although people today claim the State does not regulate morals, nothing could be further from the truth. All law is merely the culture’s value-system enforced by State Power. In fact, the only real difference between law in the Middle-Ages and today’s law is the value-system is developed independently from Biblical influences. For instance, the State still has portions of the Ten Commandments code in its law (murder and stealing come to mind), but as time passes the State drifts further from Biblical law into political law. Shockingly, as I study the historical events, the State’s increase in power comes with the church’s decrease. The unintended consequence of the reformers efforts to purify the church resulted in the splintering of the only entity strong enough to resist the State’s desire for absolute power. The avenue was now open for the birth of the absolute State, a world-order that would have been entirely incomprehensible to the men who labored during the age of faith.

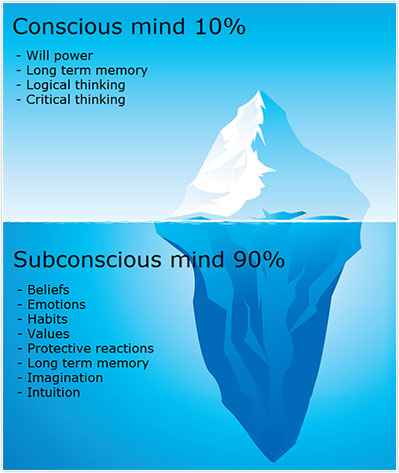

To be sure, the divine right of kings philosophy no longer influences the State, but what has replaced it (the divine right of the people), judging merely its results, is even worse. For the increase in the people’s power has not actually helped the people; instead, it has allowed the money elites, through their control of the media, to sway the masses into signing away their birthright. The absolute State can exist in monarchies, aristocracies, and democracies, but the money elites love democracies the best. Because man in mass is the predictable, in a democracy, all the elites have to do is purchase enough votes by promising government handouts and applying liberal layers of media propaganda. The predictable outcome is the mass of people dance to the paid piper’s tune. Monarchies and aristocracies, in contrast, might stand up to the elites manipulation, and why run that risk when the people are so gullible? Simply by telling the people they have the power, the people will defend the system that ensures their own enslavement, not thinking to actually examine if liberty has increased or decreased since the divine rights of people has allegedly reigned supreme.

John Adams

Be that as it may, the State democracies have led to absolute power without any moral checks upon it. The State has become God to modern man. For example, the State God controls its subjects in ways that kings from yesterday could only dream of, including: the power to tax incomes, the power to draft society’s young, the power to educate, the power to define morals, the power to create money, and even the power to punish peaceable dissent. Dismally, despite modern democracies boast of maximum liberty with equality, the actual differences between democracies, fascists, and communists is one of a few degrees. In contrast, the difference between the Middle Age State, with its moral check from the Church, and today’s absolute State, with no moral checks, is night and day.

Please don’t misunderstand me. I am not suggesting a return to the Middle Ages, but I do believe we can learn much from our political heritage. For instance, just because the church is no longer influencing the State does not mean the State is not being influence. Rather, it just ensures the older faiths have been replaced by today political religions. In other words, as the formal faiths fade, the void is filled with the hype and rhetoric of the latest “political messiah”, proclaiming his/her prophecies of the future in front of thousands of the faithful.

James Madison

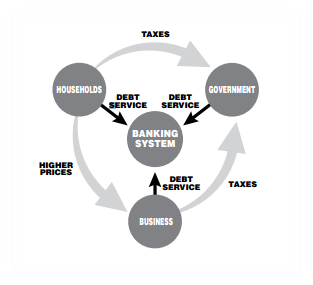

Perhaps some will think I am pessimistic, but actually I am very confident in the future. Injustice is always punished by God Almighty and I believe the Financial Matrix will ultimately damage society to the point where it can no longer deny the obvious, namely, that the State cannot have absolute power. The reason the Financial Matrix seeks to have the people genuflect to the latest political puppet is this ensures the underlying systemic causes of the mess are ignored. Yes, I am all for good leadership, but until I hear someone speak truthfully on the injustice of anyone controlling society’s money and media, I know the Financial Matrix has just applied new lipstick on an old pig. 🙂 Think about it for a minute. So long as money and media are in the hands of the elites, why would anyone be shocked the candidates (whether of the Democratic or Republican religion) are merely obedient puppets? After all, it takes hundreds of millions of dollars and constant media coverage to get elected and who controls both of these? Accordingly, State control is a foregone conclusion until money and media are set free from the elite’s grip. The Money, Media, and Military trifecta, a trifecta that has liberty in a death grip, must be broken before liberty can breathe freely again.

Alright, I will step down from my Cassandran (see Homer’s Iliad) soap box and return to my work. This year’s religious processions have inspired the faithful and my non-participation is not hurting anyone. The media can whip up that lost feeling of hope for the masses one more time as they paradoxically struggle to pay their bills in the richest society in history of mankind. I guess I am now officially a heretic of the State religion for I do not believe this religion has, nor ever will, deliver the goods. Indeed, no matter how many services the faithful attend; no matter of how many sincere prayers are offered up; and no matter how many candidates are propped up; the truth is, until the Financial Matrix ends, the people lose. Its a rigged game – heads,the elites win; tails, and the people lose.

Mass Movements Driving Change

Thankfully, the road to victory begins the moment we turn from our false religion. Instead of bowing before the political puppets, what if millions of men and women restored their conscience and character by bowing before the real Messiah? What if we admitted our addiction to debt and materialism and turned from the false idols. What if, in other words, we played defense to wipe out our debt and then offense to create the life we’ve always wanted debt-free? Then, as Financial Sovereigns, we could address the Financial Matrix and restore freedom for the next-generation.

Sure, this is an ambitious task, but what’s the point of leadership if we are just playing it safe. Some will say, people trapped in ignorance and apathy don’t know and don’t care. Nevertheless, I know I care and I know you care, for you wouldn’t have read this far if you didn’t. The Financial Fitness Program from LIFE Leadership is designed to help people help themselves and then others. Are you ready to be part of the solution? I don’t promise easy, but I do promise worth it.

Sincerely,

Orrin Woodward

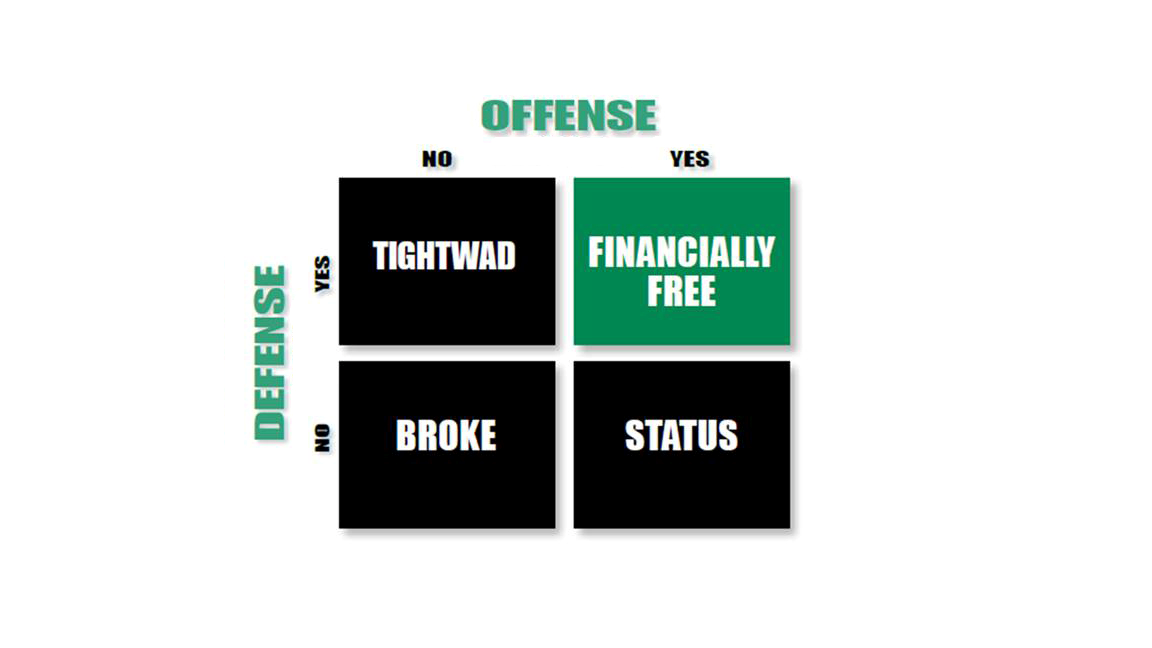

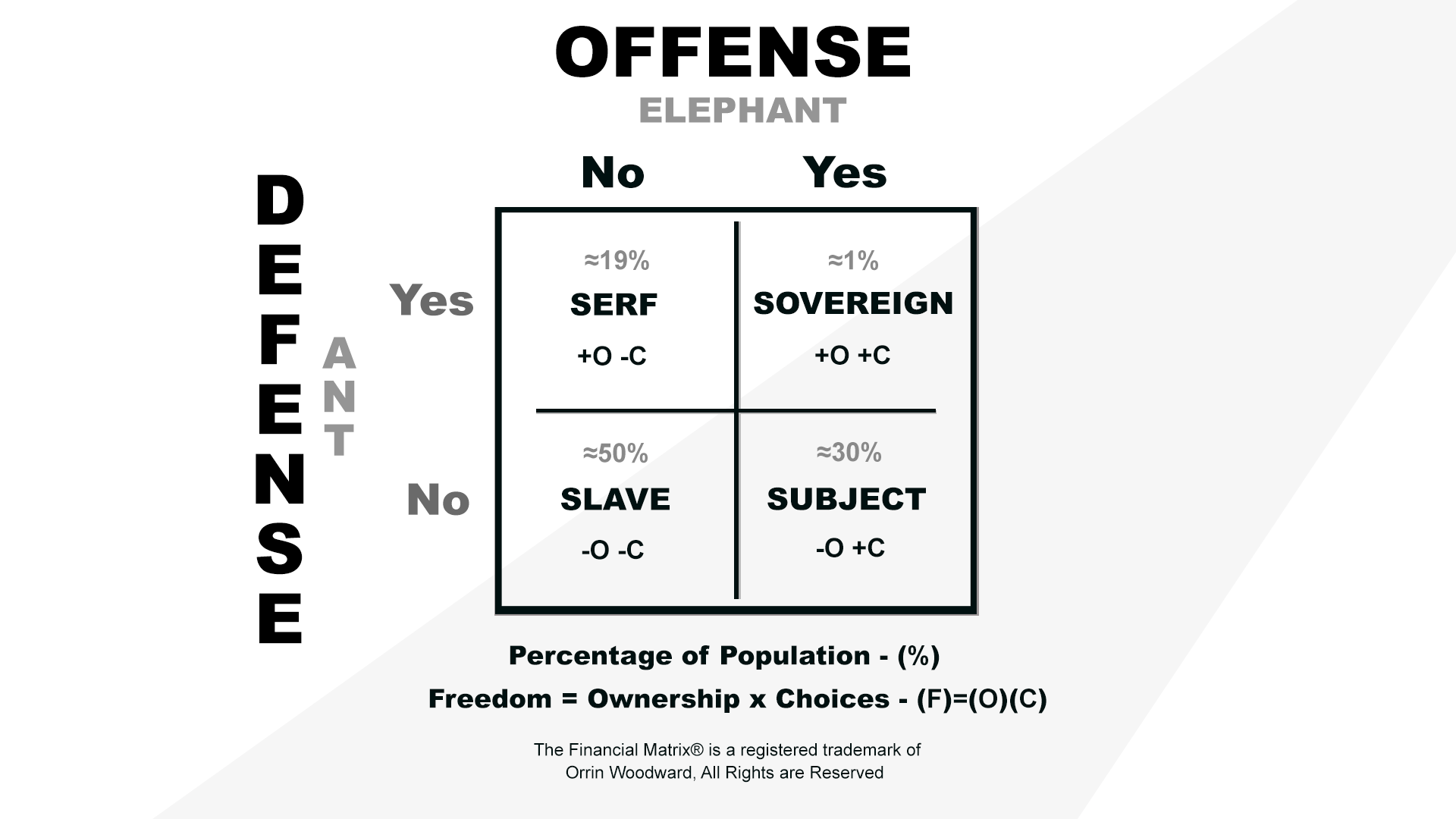

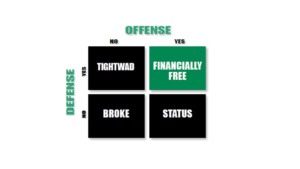

Have you heard about the Green Box Revolution? If you haven’t, you will because it’s transforming the finances of so many of your friends and family. The Green Box contains the plan to play Financial Defense and Offense to escape the Financial Matrix. In my completely revised version of The Financial Matrix book, I describe the four responses each family makes to finances, termed the Financial Matrix Quadrants. In short, it boils down to the household’s response to playing Financial Defense and Offense and the consequences of those decisions. To change one’s financial results, in other words, a person must change his financial responses on Defense, Offense, or more likely, both.

Have you heard about the Green Box Revolution? If you haven’t, you will because it’s transforming the finances of so many of your friends and family. The Green Box contains the plan to play Financial Defense and Offense to escape the Financial Matrix. In my completely revised version of The Financial Matrix book, I describe the four responses each family makes to finances, termed the Financial Matrix Quadrants. In short, it boils down to the household’s response to playing Financial Defense and Offense and the consequences of those decisions. To change one’s financial results, in other words, a person must change his financial responses on Defense, Offense, or more likely, both.