From my perspective, a perspective developed over twenty-five years of leading communities, mankind’s thirst for freedom is unquenchable. Unfortunately, however, in an effort to quench this thirst, most people grab the freedom glass from the wrong end, inadvertently losing the liberties they long for. The people, in a nutshell, chase political freedom through political messiahs rather than start with the root ingredients, namely, spiritual and economic (financial) freedom. Despite repeated political failures, the undaunted people merely double-down, pursuing the prize with more zeal (a zeal without knowledge) until society’s freedom is poured out in an orgy of political Statism. While I am all for an honorable and just political system, I do not believe any politician, regardless of their specific political affiliation, can ensure my (or the readers) spiritual and financial freedoms. In fact, I would argue that these freedoms are precursors to political freedom and where people are enslaved spiritually and financially, inevitably, they will be in political bondage as well.

Be that as it may, the Christmas season is about Light shining into darkness, a season where people should pause and ponder the message of Jesus Christ. In essence, Jesus Christ is God’s Christmas gift to us, a gift of Peace with God and Freedom from Sin – the two greatest blessings God could offer mankind. Indeed, the story of Christmas is about God intervening in history to send his Son (the God-man) to earth to fulfill the law’s punishment and free ruined sinners like us. This is the true revolution unfolding within the world and it produces real change that makes society great again. It has turned the world upside down (providing freedom for mankind) everywhere Jesus Christ is worshipped as Lord and Savior.

Be that as it may, the Christmas season is about Light shining into darkness, a season where people should pause and ponder the message of Jesus Christ. In essence, Jesus Christ is God’s Christmas gift to us, a gift of Peace with God and Freedom from Sin – the two greatest blessings God could offer mankind. Indeed, the story of Christmas is about God intervening in history to send his Son (the God-man) to earth to fulfill the law’s punishment and free ruined sinners like us. This is the true revolution unfolding within the world and it produces real change that makes society great again. It has turned the world upside down (providing freedom for mankind) everywhere Jesus Christ is worshipped as Lord and Savior.

One of the greatest questions a person ponders in life is his accountability to an Almighty God. On one hand, because God is justice, He cannot simply ignore violations against His Law, and still be just. On the other hand, because God is love, how do we experience that love if we receive what we deserve (darkness and death) rather than the mercy we need? How, in short, can God be both just and loving at the same time. The answer, an answer that turned the tide of history, is the Holiness, Grace, and Mercy of Jesus Christ, the true reason for the Christmas season. I pray that every reader, during the hustle and bustle of the CHRISTmas season, experiences the peace that surpasses understanding along with the corresponding freedom to become what God intended us to be.

This is the Gospel message – we end our rebellion against God and accept the unmerited favor of Christ’s act of grace where He freely takes our sins and we accept his righteousness through faith in Him. Who has ever heard of a love so grand, a peace so sweet, a gift of mercy so undeserved?

Not surprisingly, the anti-Christ spirit does not want people to hear this truth. Instead, it encourages enslavement through its ubiquitous glorification of sinful passions, rather than Godly principles. Satan understands that people cannot endure conscious inconsistencies between their stated beliefs and actual behavior. Predictably, as a result, when a person’s behaviors become sinful, his beliefs will soon follow. In contrast, when a person accepts by faith the death and resurrection of Jesus Christ, he repents from sinful actions to follow his new world-view, sanctifying his life by following his Savior’s example.

This is the war between the Christ and anti-Christ spirits in the world. A person is either following Light or groping in darkness. Don’t be fooled by the media’s anti-Christian lies; instead, read the Bible for yourself, preferably starting with the book of John. See for yourself how Light shined into darkness and freed the enslaved from sin. True freedom, in other words, begins with the freedom to serve God and others without guilt or shame, knowing we are sons and daughters of the King.

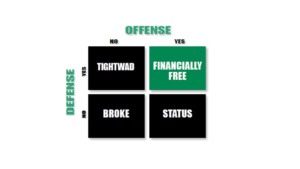

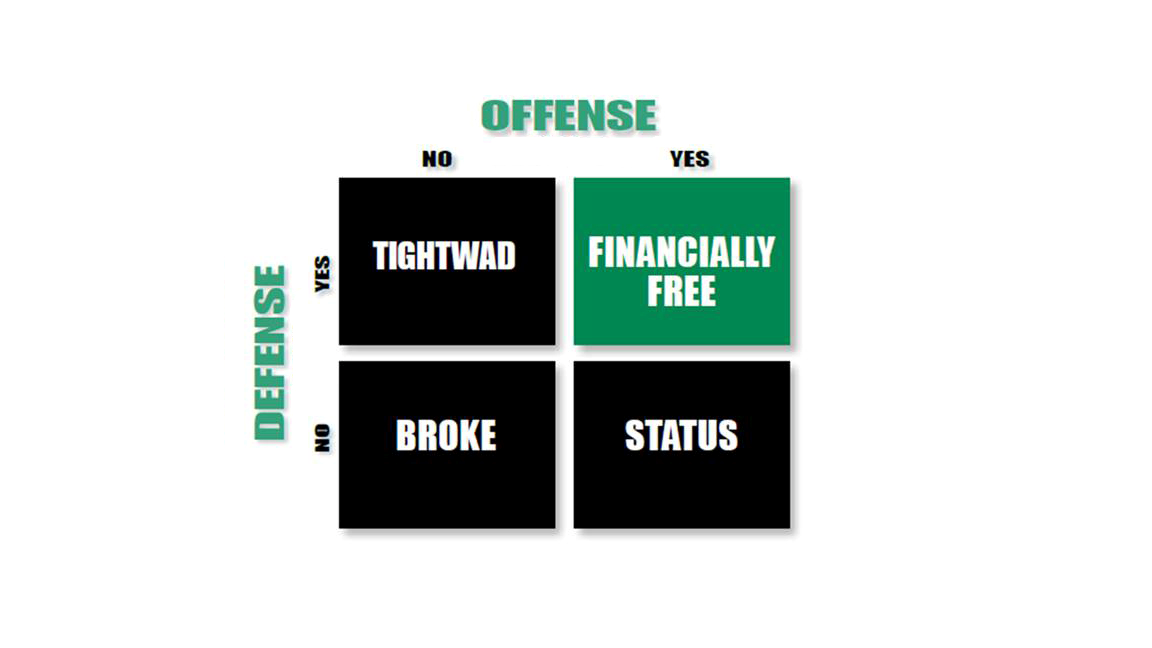

Needless to say, however, just because Christians have grabbed the freedom glass from the proper end, does not, by itself, indicate the war is won. If anything, the real war has just begun, for now the person must live his Faith before a watching world. After all, now that he is spiritually free, it’s time to tackle the next freedom – economic (financial) freedom. Curiously, many Christians behave as if the gift of spiritual freedom does not come with corresponding responsibilities, but the Bible teaches to whom much is given, much is required. Certainly, a spiritually free person should progress to economic and eventually political freedom, for what is the purpose of freedom if it doesn’t glorify God and serve others?

Christians must live their faith by applying Biblical principles into their personal finances and achieve financial freedom, giving them a bigger platform to serve God and man. Indeed, I believe one of the greatest indictments against the Christian church today is its failure to be Salt and Light in the world possibly because it is too much in love with the world. The Bible does not teach Christians to immerse themselves in the world’s ways, but rather says to be in the world but not of the world, shining Light into the darkness. Sadly, many Christians have surrendered their Light to the anti-Christ agenda and entrapped themselves in the Financial Matrix despite the Biblical admonition that borrowers are slaves to the lender. Does anyone think the world will take Christians serious when the talk about Christian liberty when they sold themselves into financial slavery for material things?

How can a spiritually free person, a Christian, believe God wants him to sell himself into the anti-Christ financial system that enslaves billions of people? This is the absurd and the epitome of the double-minded hypocritical person James reproached as unstable in all his ways. What material thing, after all, is so important that one should become a slave to own (or should I say borrow) it? Let each reader examine himself. Debt is nothing less than a financial cancer eating away at the household’s financial health and anyone who willingly introduces cancer into his family is not leading in a Biblical fashion.

To be sure, a mortgage may be necessary temporarily to obtain a housing, but why compound the debt further by leasing cars, accumulating credit card debt, and buying other toys on credit. To be fair, I don’t believe most Christians intend to be hypocritical; instead they simply have not studied the good Book enough to realize they are violating many of the financial principles present. Christian pastors, as a result, must not only share the good news of spiritual freedom, but also how the spiritual freedoms lead to economic freedoms, which finally produce society’s political freedoms. This is the historical path to political freedoms and repeated attempts to grab the freedom glass from the wrong end will inexorably lead to more Statist’s tyranny until the people repent of their folly.

Unfortunately, today’s Statist anti-Christ rulers have no interest in people seeing the Light and escaping the darkness because it’s the people’s uncontrolled passions that lead to the elites absolute power. This shouldn’t shock Christians, for the Bible clearly describes how the rulers conspire against God and His anointed One. Thankfully, their plans will be foiled as they break themselves upon the Rock that cannot be broken. The world, in reality, is a great cosmic drama where history unfolds between the powers of Light defeating the powers of darkness in a war with no-quarter. Each person must identify which side he is on in this war and then determine the role he has been called to play.

As for me and my family, we have been called to set people free (spiritually, economically, and politically), knowing that spiritual freedom is the ultimate freedom. With that said, however, we have found the easiest place to start is by teaching people financial freedom. For once trusts is gained in the area by showing the effectiveness of the financial principles, the door is open to share the truths of freedom in all areas. We spend our lives teaching people about spiritual, economic, and political freedoms while encouraging others, others who are tired of living lives of quiet desperation, to do the same by coming into the Light. When enough people turn to Light spiritually and financially, the political changes needed will occur as the spiritually and financially free people demand to live politically free.

LIFE teaches people how to live financially free through utilizing our best selling product, the Financial Fitness Pack. The information inside the green box revolutionizes a person’s finances, and in the process, exposes him to truths in others areas. The goal is to set him free so he can then help others get free. Indeed, LIFE is not our business built on purpose, but rather our purpose built on business. This Christmas season, don’t just open up gifts; instead, open up the gift that endures forever, the saving faith in Jesus Christ. By grabbing the freedom glass from the proper end, freedom will prosper in all areas as we spend the rest of our lives reflecting His Light in a dark world.

The Woodward family wishes everyone a Merry Christmas and proclaims Glory to God in the highest, and on earth peace, good will toward men.

Sincerely,

Orrin Woodward