Get the Green Box: Financial Fitness Program

Posted by Orrin Woodward on January 4, 2017

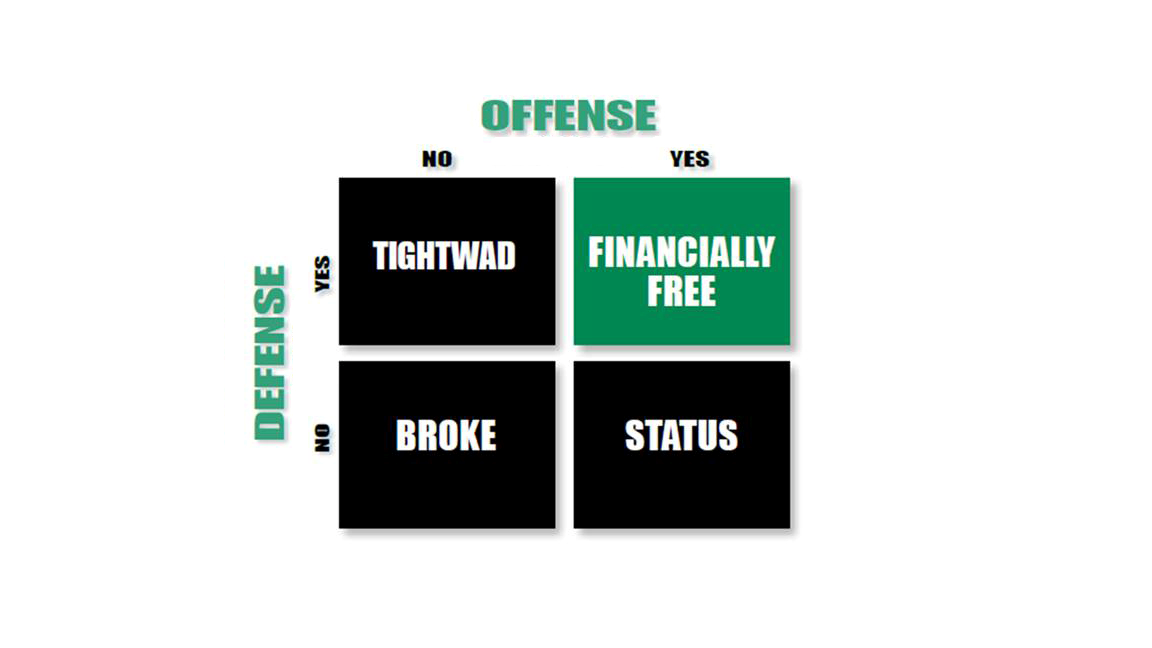

The Financial Matrix graph displays the four ways people can respond to the Defensive and Offensive principles needed for financial success. Strangely, most people, through a combination of ignorance, apathy, and arrogance, ignore these financial laws and suffer in consequence. 2017, however, is a new year, a year to erase past failures and replace them with future victories. This can be achieved through the Financial Fitness Program, the greatest financial game-changer on the market! But before I get ahead of myself, let’s examine the Financial Matrix quadrants to determine where the reader resides currently to ensure we develop the best personalized plan for the future.

Let’s start with the Broke quadrant, the one where people play neither Defense nor Offense. Disastrously, over 50% of households in the USA fall into this quadrant, service debts higher than current incomes and thus falling further and further behind every year. Moreover, they have little Offensive wherewithal to expand incomes and thus are stuck in a situation where they have more outgo than income with little hope of changing it. The 45 Year Plan for the Broke group, those who have no net worth (assets minus debts), displays expenses higher than incomes and debt loads increasing until they are rejected for further loans (debt maxes out around 3 to 5 times total household income). Needless to say, this is the worst spot in the Financial Matrix, because it maximizes debts and minimizes dreams. The Broke quadrant pays the price for revolving interest, penalty fees, and stress because they lack financial literacy. They live lives of quiet desperation with no assets, massive debt, and little hope to change unless they can access new information and inspiration. The most common expression one hears from the Broke quadrant is, “I owe; I owe; it’s off to work I go,” while the most common attitude is hopelessness because they see no way out of the Financial Matrix.

The Tightwad quadrant, on the other hand, plays Defense (expenses below incomes with decreasing debts), but doesn’t play Offense (little ability to increase incomes). The 45 Year Plan for Tightwads shows expenses under incomes with little debt to service. Although debt free (or at least progressing towards debt freedom), they only accomplish this by reducing their dreams. This is why most people HATE to talk about finances because they believe it’s just a plan to budget someone out of their dreams. While nothing could be further from the truth in the Financial Fitness Program, to be fair, this is where most financial gurus live. They spend hours talking about how to reduce debt and very little discussing how to increase incomes. As a result, most people do not follow apply Defensive principles because to do so results in them giving up their dreams to be out of debt. While this, to be sure, is better than remaining in the Broke quadrant, this Financial gurus are only teaching half the story, at best. For when a person surrenders his dream, a dream that drives his personal growth, he has thrown the baby out with the bath water. Sure, being debt free is a good, but the biggest enemy of great is good and I refuse to sacrifice the great on the altar of the financial gurus good! Why settle for debt-free without dreams when one can learn how to live dreams debt-free. The most common expression in the Tightwad quadrant is, “No thank you. We cannot afford this.” Naturally, after years of self-denial with little to show for it, the most common attitude that results is bitterness, a bitterness caused by repeatedly saying “no” to their dreams.

The Status quadrant, in contrast, plays no Defense (debts increase as fast as incomes), but has an impressive Offense (incomes capable of servicing all debts). The 45 Year Plan for this group displays both incomes and debts increasing. Because they have a solid Offense, but not a corresponding Defense, the total debt loads continue to increase (usually two to five times total income). To be sure, they have enough income to stay ahead of expenses, but only so long as they continue to perform at the top of their game. This group believes it can live their dreams, expand their debts, and live the good life. However, there is a major downside to living in the Status quadrant, namely, the inherent risk that something outside one’s control may occur. Similar to a bobber floating on top of the water, just one financial tug (job loss or health challenge) can lead to the household going underwater financially. After all, if someone lives at his debt limit, he runs the risk of financial catastrophe if the Offense is interrupted unexpectedly while the debt continues to compound expectedly. Debt, to the Status group, appears to be gold – they live their dreams while servicing their debt. But in reality, it’s a golden handcuff that tightens around its unsuspecting victim. Over time, the Status group realizes they are stuck on the financial gerbil wheel, running with everything they have, without the ability to jump off. The most common expression in the Status quadrant is, “Let’s buy it now because we can afford the monthly payments.” The danger, of course, is this commonly leads to arrogance, for when a person shows it all and owes it all, if he’s not careful, he can tend to believe he knows it all.

Unfortunately, by the time the Status quadrant realizes the errors in their strategy, it’s usually too late. Once the Offense loses some of its muster, it doesn’t take long for the Status household to start missing debt payments. Ironically, the group learning the most from the failures of the Status households is the auctioneers, who sell off the remaining assets of financially ruined families. As noted in The Millionaire Next Door, auctioneers are the profession with the highest percentage of millionaires, probably because they see and feel the pain of the families who have lost everything by playing Offense and ignoring Defense. This lesson reveals the insecurity inherent within the Status quadrant, a quadrant that believes it can outrun debt forever. As a result, most of the Status quadrant is one economic downturn away from bankruptcy. Debt is omnipresent and compounding continuously against the household; thus, it should not be played with for similar to fire, if you play with it, you will eventually get burned.

The final quadrant, the one everyone should aspire to join, is the Financial Free quadrant. This group plays both Defense (expenses below incomes with decreasing debts) and Offense (increasing incomes). The 45 year plan for this group displays expense remaining fairly constant while the incomes consistently grow. Debt decreases annually until it is eventually eliminated by the difference between incomes and expenses being used to wipe out the household’s debt cancer. The Financially Free group sacrifices in the short-term by living below their means and wiping out debt so they can live their dreams debt free! This quadrant is the most secure financially because they own assets and live their dreams debt free. This gives them great strength when financial setbacks do occur because they owe no one anything. Instead of reducing their dreams to pay off debt, they increase the size of their dreams without falling into debt; rather, they use dreams to drive personal improvement (Offense) and use the increased income to pay off debt even faster. In other words, increased dreams and decreased debts. This is the Financially Free lifestyle. The most common expression for Financially Free people is, “Let’s sleep on it first. Then, if we truly want it, let’s set an Offensive goal to achieve it.” Not surprisingly, the common attitude of this group is thankfulness because they realize they have been blessed by following certain financial principles and aim pay that blessing forward into other’s lives.

Laurie and I dreamed to escape the Financial Matrix and now dream of helping millions more do the same. The Bible teaches, “The borrower is slave to the lender,” indicating a person in debt is in bondage. If someone loves his bondage, then I am not here to argue him out of it. However, if someone recognized himself in one of the above sub-optimized quadrants and desires to live Financially Free by escaping the Financial Matrix, then he needs to get the Green Box (The Financial Fitness Pack). If a person is already Financially Free, then I ask you to get the Green Box and help me help others by teaching these financial principles to the world. In the Green Box, the person will learn the Defense, the Offense, and the pathway out of the Financial Matrix playing field. Further, he can plug into a community of winners to be held accountable to the proper financial principles, playing Defense and Offense, and referring others to do similarly.

In closing, the beginning of all breakthroughs starts the moment a person realizes the road he’s been on will not take him to the destination he desires. This was true for Laurie and me, as we lived in all three sub-optimized quadrants seeking to escape the Financial Matrix. It’s now 2017 and last year’s successes and failures are history. Now it’s time to start this year with momentum. If a person truly wants to live the life he’s always wanted, perhaps it’s time to address the issues you’ve always avoided.

Sincerely,

45 Responses to “Get the Green Box: Financial Fitness Program”

Sorry, the comment form is closed at this time.

Erik Adrian Cotera Yactayo said

Dear Mr. Orrin, thank you for sharing this personal finance program, I’m reading it and I’m changing the way I look at the money and it tells me the wrong way I was handling my money. Thanks

Orrin Woodward said

Great job Erik! Changing the way one thinks, changes the way one acts! You are on your way. God Bless, Orrin

James Carthy Sr. said

Awesome post!!! Thank you for the reminder of what is at stake!!!

Jim Carthy

BP said

Orrin,

There is no doubt this program will change people’s lives.

God willing, Sherry and I will be able to fulfill Prov 13:22.

I’ve learned the hard way, that there is a too late!

God Bless

Brian n Sherry

Pat Edwards said

Thanks for a wonderful article Orrin. 2017 a new year for change and growth; financially, personally and spiritually!! Time to shift gears, face the facts and jump quadrants!! Happy New Year!!

Lyndon Bell said

Hello Orrin. This is an excellent explanation to the Financial Matrix graph. It is very relatable and easily understood. Thank you for so clearly helping us identify the quadrants we have lived. Thanks to the Financial Fitness Program we have learned to apply Offense and Defense. The Program has enabled us to move from the Broke and Tightwad quadrants, towards the Financial Freedom quadrant. We are very grateful to see the same results in the lives of others we know that began and applied the program. This information is truly life changing for the person who is hungry for a better financial future. Thanks

CJ Calvert said

Thank your Orrin for another fantastic post. Your 4 Quadrants of the Financial Matrix Graph is one of your greatest creations: simple, obvious once explained, and logically inarguable. Shannon and I are comitted to make lasting change in our personal finances in 2017 to set the example for our team.

Keith and Lynn Burns said

Thank you Orrin. An excellent post to describe the fantastic “Green Box”. My wife and I have used the Financial Fitness program to wipe out all of our consumer debt (car loans, student loans, credit card, medical bills) over $40,000!!! in just 2 years just by applying this information and changing our thinking. This allowed my wife to leave her job last May and we are continuing to work on our Offense to achieve Financial Freedom. By associating with people in LIFE who are working together to bring this information to everyone. This information is needed by EVERYONE and we will continue to help bring others into the light.

Orrin Woodward said

Keith, that’s FANTASTIC! $40,000 of debt wiped out! You two are on your way to escaping the Financial Matrix!! 🙂

Keith and Lynn Burns said

Thanks Orrin, couldn’t/wouldn’t have done it without FFP!!

Tony Hoffman said

The first thought that came to my mind is the truth will set you free – now it is our responsibility to apply the truth and pass it on to others so they have the same opportunity!! Thank you Orrin for the continued clarity in our mission and messaging!!!

Curt Spolar said

👍

Curtis Spolar

Sharon Hoffman said

Everyone needs the green box!

Larry Cheatham said

Orrin, you have again done magnificent work in spelling out the different attitudes and mindsets as we each continue on our journey in one one of those categories you’ve explained in this Financial Matrix article. What I love is that anyone can read this while viewing the diagram and immediately self diagnose where they are in the financial matrix. It also helps to create a compelling case for why everyone should purchase and apply the principles in the Financial Fitness Program. With over 60,000 in consumer debt eliminated I know that I am thankful I did. It has truly changed me and my family’s life and it is allowing me to pay it forward to others in search of answers.

Thanks for your friendship

Larry Cheatham

Doug DeWitt said

This program works as evidenced by testimonial after testimonial of couples and individuals getting and staying out of debt! I recently had someone contact me who used the principals and in a year paid off $15,000 in debt, started building a savings account. paid off a credit card, paid off student loans, and is on tract to be debt free in the near future! It works!! Thank you Orrin for caring about other people and having the leadership skills to communicate a way out!!

Eric Stewart said

Another great blog Orrin. As a pastor I am so thankful to have access to information like this. The bible certainly teaches the offensive side of finances in the Dominion Covenant, “Be fruitful and multiply and fill the earth and subdue it” (Gen. 1:28a ESV) as well as the defensive of not being in debt as you pointed out, “…the borrower is the slave of the lender” (Pr. 22:7b ESV). These are things I have been able to continue to strive for personally as well as teach others in our congregation thanks to your leadership and teaching. We as Christians should strive for financial freedom and use our wealth that God blesses us with to extend His Kingdom in history!

Orrin Woodward said

Amen Eric. I appreciate your Godly example and teaching in helping people escape the Financial Matrix!

Bryan Vashus said

Those who apply these principles cannot lose. The “rubber meets the road” at application. Great stuff!

Mike Hartmann said

It’s too easy to glance at the descriptions of the Financial Matrix Graph and assume, “Yeah, I got it.” The time you spent summarizing the depth of each quadrant is priceless; I appreciate your insight and detailed explanation.

Tonya & I began this year by sharpening our pencils and reanalyzing our monthly budget based on our historic expenses as tracked over the past 12 months. We established new bogeys in all major areas of our spending (develop the plan) and have committed to each other to increase our awareness and discipline to track our daily cash outflow (work the plan). Finally, weekly and monthly reviews (check the plan) will truly be a key in making 2017 a turning point in our household as, without solid data, our financial opinions are worthless. We would have never taken this step forward without the principles of the Green Box & an environment that celebrates Financial Freedom.

Thanks again for everything & Happy New Year! Here’s to making 2017 our brightest year ever!

Steven Limanni said

Thank you Orrin for defining the quadrants even further. Your explanation of each will allow me to get my message across that much easier, when presenting this opportunity! We are Blessed to have you, Laurie and the whole LIFE team, pointing us in the right direction. 2017 WILL BE a great year for the Rhino’s and for all those who are following your lead. Much appreciated!!

Chris Swanson said

I’ts funny how for thousands of years the biblical rules of financial success still apply. Well played Mr. Woodward.

Jim Robson said

Orrin, WOW! I’ve been showing this “FF Quadrant” without understanding its Power all this time! Thanks for the schooling!!! Bigjim

Lisa R. Malone said

Wow Orrin! You hit the mark! I actually seen myself sailing the quadrants throughout my life’s journey. I believe I’ve experienced each one at some point in my life. Can’t wait to read it again😊

Terry Franks said

I remember in one of your tweets you said, “I count him braver who overcomes his desires than him who conquers his enemies; for the hardest victory is over self.” Your insights are always appreciated. The “green box” can change family thinking for generations!

Holger said

Awesome post, Orrin, thank you for taking the time to write this. That is amazing, 50%+ in the broke category… In 9 years of college, 3 Masters Degrees, including a Top 25 MBA, I never learned any of the 47 financial principles taught in the FFP. We are blessed to have access to it now and our lives have changed forever… God Bless!!! TTD!!!😀

Leslie Gebhart said

One Green Box will lead to lots of green lights! Thank you Orrin for a great explanation of the Financial Matrix Graph, I will be passing along this blog as opposed to explaining it myself~ nice SYSTEM. 🙂

Justin Saroyan said

Great article Orrin! The visual clarity of your four quadrants makes it very easy to see where one is and where one would rather be. Just as Kiyosaki did this for ESBI, you’re now reaching millions with your quadrants!

Robby Palmer said

Orrin,

Literally, this could be read at the open meeting explanation and be effective. Genius.

Emily and I and our teams are going through the program fresh right now, and every time I begin this book, I am more and more blown away by its power.

Retracing steps isn’t easy, and it’s so good to know we have a guide. Thank you for sharing.

steven j sager said

What a great oration of that green box! I don’t even have enough space to type out the countless/jaw dropping stories of the amount of debt personally eliminated; as well as those who we shared (the green box) with our Community have done as well.

So I just wanted to share one recent story of a lady who works at a doctor’s office and has two other jobs to service off her credit card and college debt.

She got the green box and in less than thirty days, she eliminated $1,800 of credit card debt!! WOW! For the $120 investment into her thinking, I’d say that paid off! Go Green Box Go !!

Steve Sager

Dream Big!

Thomas Hinds said

This is so clear the way you wrote this blog Orrin. Thank you!

Sonya Strawn said

Orrin,

This is the best description of the quadrants! You’ve made it so simple to comprehend.

I’ll be printing this article off and carrying it with me wherever I go- for my own study and as a reference tool.

Thank you for your leadership and wisdom to help all of “Us” move forward with the TRUTH!

Sonya Strawn

Turhan Berne said

Thank you Orrin for another awesome article!! We all appreciate the time you take to break finances down into easy to understand categories!!

Tina Abernathy said

Another great article Orrin!

Thanks for making the complex simple. ….In the words of Frederick Douglass “Knowledge makes a man unfit to be a slave!” The FFP provides the knowledge to allow us and anyone who chooses to implement to free themselves from financial slavery.

Onward to 1million and beyond

Bob Quintana said

Orrin, BRILLIANT! (as usual, my friend)! You’ve once again combined powerful, principle-based concepts with amazing simplicity that anyone can understand and, most importantly, apply! Thank you for sharing your article with Pennie and me! We have personally benefitted from the content of the FFP “green box” since I first picked it up over a year ago, and reading your article today has inspired me to pick it up and listen to it again as a refresher — What a great way to start off the new year!! Pennie and I feel extremely blessed to have you and Laurie in our lives and to consider you both dear friends! Thank you again for all you do — and for who you are — in the world!

Alex MacDonald said

Orrin, thank you for this! You never cease to blow my mind. You’re brilliant but have such a way of simplifying everything for people like me. You have an uncanny ability of taking things a few layers deeper and relating various things together. I’m so glad you were an engineer but so much more thankful that God has called you to lead so many. This helps me understand my position better and helps me relate and share it with others better. I see the vision for better tomorrows and the shift of power happening and you are a major catalyst of that spark. I am excited for our freedom day and to reside in that green box because of the information and inspiration in that Green box!

Dave Bailey said

Thank you, Orrin, for your insight & continued Leadership!

Ernie Robinson said

Dear Orrin,

I am so glad I heard your Lifeline steering me to this explanation of the quadrant! I’ve been following principles from the first few chapters of the Financial Fitness Program, and dumped $15,000 of pension investment into paying off debts…but the debt came back — because instead of finishing the Financial Fitness Program, I got busy building my group. I went on hold…

But now my good friend is getting started with LIFE and trusts that I have found the answer to his financial stress. I now MUST get through the material— so I can help him with credibility!!

I must get serious about applying your wisdom myself — or I will be a hypocrite! I’m motivated more, knowing my friend needs this program: he loses sleep over his lack of retirement savings, and the many debts on which he can only make minimum payments.

They have two professional incomes! So your work is a Godsend to both of us, and to the many more I have coming onto my LIFE team.

Thank you, and bless you, Orrin….I hope to meet you in person someday…my friends Trevor & Julie MacDonald and Alex & Leighann Nickerson tell me I can!

Gregory Nelson said

Thank you for the excellent leadership and life skills you are providing to the world. What you guys are doing at Life Leadership is nothing short of amazing.

Mike Pistacchio said

Orrin. The best and most relatable text yet to explain the Fiancial Matrix to anyone. First, determine where you are. Then choose to move or stay there. That single action is up to you and you alone. Thanks again for making the obvious useable.

Elizabeth Sieracki said

Thank you for this summation of the Green Box!!

Sherrie Clark said

Orrin

I am celebrating my first week of complete debt freedom due to the applied principals in the Green Box. I am nearly 53 years old and had been drowning by as much as $440,000 in debt in my mid 40’s. When I first heard a financial CD from Life Leadership, I was upset…then I recognized it was the truth! I was self employed restaurant owner working a 100 hours a week to support my status driven lifestyle. Boats, Cars, Timeshares, Big Mortgages…BUT NO TIME! I had a lot of OPM…(Other Peoples Money) and the stress and pressure of having to perform at the expense of having no quality time for my daughter. I have not had huge business success here as of 2016 and I certainly did not break any records getting completely debt free…but now that I am debt free I feel completely worthy and compelled to share the Green Box and Debt Freedom with everyone who wants a way out of the Financial Matrix!!! If this 53 year old single mom can fight her way out…so can anyone who is willing to be lead by this fantastic group of leaders…Thank You and all the PC for creating such an amazing debt reduction program and offensive opportunity to create complete financial freedom in my future!😘 See You at the TOP!

Orrin Woodward said

Sherrie, in my opinion, you are one of the most successful people I know, for you applied Financial Defense and Offense to Escape the Matrix! Now, you can message that to the world with 100% confidence it will work for anyone willing to work the plan! GREAT JOB!!! God Bless, Orrin

Chrissy Milazzo said

First, thank you to all of the LIFE Leaders for your guidance, leadership and for being character driven. I am grateful for all of you and your worldly example.

Our team has been reworking our FFP ever since Louisville and someone asked us a question about Principle 1. If you have 10% of your check automatically put into a 401K is that satisfying Principle 1 or does it have to be put into a savings account?

Orrin Woodward said

Chrissy, great question! Money put into 401ks is pretax and if a person has debt, I would put in as much as the company matches and still pay myself 10% after-tax so I can build a nest egg to wipe out ALL Debt. In fact, this is what we did, I put 6% into my 401k, paid us 10% after-tax, and wiped out all our debt through the Defense, Offense from the principles in the Green Box and then went Turbo-Charged Offense to really CRUSH it! 🙂

Phillip and Zair Sanchez said

Thank you, Orrin for a great revelation on how the world sees the money view. I am slow learner, My wife Zair and I are trying to start working together and putting in place the right habits nessary to be successful. We have moved from broke to tightwad and want to start working on the offense to financial freedom. Thank you Orrin for helping us change our habits and our thinking. God Bless!