Commodity or Debt Money?

Posted by Orrin Woodward on December 4, 2015

“The great question which in all ages has disturbed mankind, and brought on them the greatest part of those mischiefs which have ruined cities, depopulated countries, and disordered the peace of the world, has been, not whether there be power in the world, nor whence it came, but who should have it.” – John Locke – First Treatise of Government

Power, as John Locke inferred, is an omnipresent force in the world. The strong, from the creation of mankind, have ruled over the weak, subjecting them to various degrees of oppression. Although many believe the worst is behind us with the end of slavery and serfdom, this may not actually be the case. For the modern Big Bank/Big State/Big Business marriage, known as Crony Capitalism, has increased the elites’ control over the weak through the power of leveraged debt. This subtle form of coercion (through the fear of debt collectors harassment, mortgage defaults, and bankruptcy proceedings) forces many people into the purposeless quagmire of long hours, loads of stress, and yet little real ownership. In effect, today’s indebted people do not work to own anything but merely work to service debt. This, however, is historically little different than the slave or serf was also coerced into working without owning. No wonder Solomon once wrote, “There is nothing new under the sun.”

Whereas Slavery was a Physical Matrix of control and Serfdom was a Feudal Matrix of control, what should we call the financial subjugation of society? I termed it the Financial Matrix and I believe it’s the elites most powerful matrix of control yet. Why? Because few people even know it exist let alone know how to resist it. While a slave knew he was enslaved physically and a serf knew he was trapped on the lord’s land, few comprehend that debt traps a person to the financial lords. In other words, a person in the Financial Matrix is enslaved and yet believes he is free; in consequence, escaping the web of debt is very difficult because he is not even aware he has been captured. The elites, on the other hand, understood quickly the benefits of the masses feeling free while actually being entrapped by their lack of financial literacy. The Financial Matrix, in other words, ensured the masses worked harder and longer than slaves or serfs were while reaping little longterm rewards. Simply looking at the statistics of the average person’s wealth at 65 is enough to demoralize anyone. How can the masses work that long and have so little to show for it? Simply put, a lack of financial literacy entraps them into the Financial Matrix the benefits the elites and breaks the masses.

The economist Henry Macleod highlighted the power and influence debt money has had upon society when he noted, “If we were asked – Who made the discovery which has most deeply affected the fortunes of the human race? We think, after full consideration, we might safely answer – The man who first discovered that a Debt is a Saleable Commodity.” The importance of Macleod’s statement cannot be overemphasized because until the reader understands its underlying message, he will think I am exaggerating the effects of debt upon people’s freedoms. Nonetheless, no less an authority than Ludwig Von Mises (one of the early members of the Austrian School of free market economics), pointed out the key differences between commodity money and debt money. Mises defined money as simply society’s most in demand commodity (typically silver or gold).

The free market has never chosen paper bank notes as its money of choice freely. Hence, when the banking system discovered they could make debt a saleable commodity, it needed to partner with the State and use its “monopoly of force” to coerce society into using debt money through passing legal tender laws. Not surprisingly, the States gladly accepted the cheap debt money created out of nothing by the Big Banks and then forced society to do the same. This is a win for the Big Banks (massive interest profits) and a win for the States (massive increases in power from access to funds) and a massive loss to society in increasing debt and inflation while decreasing the people’s freedoms. As a result, the Financial elites now control the State and the State controls society (the same old story of the strong oppressing the weak) through the Financial Matrix’s system of control.

Author Felix Martin noted in his interesting book Money, “For credit to become money, sellers must also trust that third parties will be willing to accept the debtor’s IOU in payment as well. They must believe that it is, and will remain indefinitely, transferable – that the market for this money is liquid. Depending upon how powerful are the reasons to believe these two things, it will be easier or harder for an issuer’s IOUs to circulate as money. It is because of this third critical element of transferability that money issued by governments, or by the banks which governments endorse and backstop, is thought to be special. Indeed, there is an influential school of thought – known as chartilism – which argues that governments and their agents are the only viable issuers of money.”

Martin, although brilliant in his historical analysis, is an apologist for the Financial Matrix and supports Statism in monetary matters (State intervention into society’s money). Thus, it’s not shocking he supports the State’s role in legalizing and supporting the creation of debt money. In reality, the State must get involved if debt money is to survive in society, for no one would accept the bank notes without the State’s unnatural coercion. Again, this is nothing less than State coercion over society to for the benefit of the strong (Financial and Political Elites) over the weak (the masses). Interestingly, however, when the State collapses the paper banknotes return to their true value – nothing. State force, in other words, is the only thing that props up the value of the fiat paper notes. A true commodity money, as Mises points out, does not need State intervention to prop up its value because it marginal utility is determined by the market, not a dictating State. All the State needs to do in a free market system is define the amount of gold and silver in its monetary unit. Then, the State should ensure the weights and measurements remain unchanged. Of course, the marginal value of the monetary unit will change as the production and consumer demand for money changes, but the standard itself should never change.

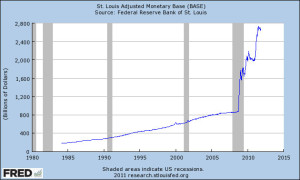

The money supply will change slightly as more gold is discovered, but not anything close to the amount it changes in the Financial Matrix. For instance, the total value of the gold and silver mined during the entire time the Spanish controlled its South American colonies was approximately $250 billion. In comparison, the Federal Reserve increased the money supply by $250 billion in digitized debt in just one day during the 2008 Great Financial Crisis. What took the Spanish State over 250 years to accumulate, in other words, the Federal Reserve accomplished in mere milliseconds! Disastrously, the State’s “monopoly of force” is no longer used to ensure justice for its citizens, but rather to ensure Financial Matrix injustice. How do you win an argument against a person who has a gun pointed at your face? No matter how logical or reasonable your position is, the person with the gun always gets his way. In a similar fashion the State always wins an argument regardless of how illogical its position is. 🙂 Does the reader now understand why its absurd to surrender control of the money supply to the Big Banks/Big States Financial Matrix?

Banker apologist, Felix Martin, concluded, “If money was such a powerful invention – such a revolutionary force for the transformation of society and the economy – the next question is obvious. It is one posed with brilliant clarity by the father of English political philosophy. It is to the perennial battle over who controls the money that we therefore turn next.” Martin, in reality, has posed the wrong question. And, when someone asks the wrong question, he rarely receives the right answer. The real question is – why does anyone need to control the money supply? Why not let the market determine the commodity, quantity, and price of money just as it should all other commodities? Isn’t this the definition of a free market and freedom for the people? A free market is where no one controls the supply or price of any commodity within society; instead, the marketplace (consumers) determine demand, supply and price based upon the sum of the individual valuations.

We are fast approaching the end of the road and we only have one fork remaining. Down the current path is the Hayekian road to serfdom while the last for is the path returning to freedom. Unfortunately, most people spend their whole life working for money, all the while, remaining ignorant as to what money is and how personal debt controls them. LIFE Leadership has vowed to right this wrong by by sharing the Financial Fitness Program principles of financial literacy with the masses. I can think of no better way to fulfill my God-given purpose than to take the principles Laurie and I learned to break free from the Financial Matrix and teach them to others. It’s time for LIFE Leadership to set millions of financial captives free!

Sincerely,

52 Responses to “Commodity or Debt Money?”

Sorry, the comment form is closed at this time.

Robby Palmer said

I see it!! You’ve cast the vision. I believe we’re truly in trouble. What lies ahead? If people will trample people over a TV, what happens when the finances crash?

Orrin Woodward said

Robby, I can tell you what doesn’t happen. Those who are out of debt and built wealth will get amazing deals as most people sell everything to survive. Financial Wisdom can be learned through studying others success or experiencing your own failures. The Financial Fitness Program offers the easier way to gain the wisdom. 🙂 thanks, Orrin

joshua said

I agree with orrin. I tried and was doubting about it at first. Very legit and very good education. thanks again life leadership

Gyorgy Veszpremi said

Another great post, Orrin. Thank you very much for sharing.

Orrin Woodward said

You are welcome Gyorgy. It’s time to help a whole bunch of people break free from the Financial Matrix. 🙂

Dennis Higgins said

I both loved and hated this article; I loved the revelation and clarity of this post but I hated the thought that our country/society/world is being controlled by so few.

It appears that getting out of the matrix and teaching others to do the same is the only way to start limiting this control.

Valente C Herrera said

Whoa! the truth will set us free all others must have data!

Thanks Orrin.

Rob Brown said

The old story of the watchman on the tower comes to mind when it comes to you. Thank you Orrin.

Scott said

Thank you for continuing to share the wisdom you have gained through years of studying the Financial Matrix. This is more motivation to work harder doing the right things to get out of the Financial Matrix faster. My family is already experiencing some great results from implementing the Financial Fitness Program. Just today my mechanic showed me a repair that needs to be done on our family car because it is a serious safety issue. Before the FFP we would not have had the $1400+ this repair is going to cost already set aside in an account for costs like this. We are a single income family with 3 kids 5 & under. My choice would have been put it on a credit card or put my wife & kids safety at risk.

Before the FFP and LIFE 2.0 we had little hope, today that is not the case!

Orrin Woodward said

Scott, this is EXACTLY why I do what I do because more people need to be exposed to Financial Wisdom so they do not live in debt and the stress associated with it. Imagine how many families in similar situations add it to an already bulging credit card balance and then fight about bills or get another job or file bankruptcy – all due to lack of Financial Wisdom that can be purchased for $99 and association with a community of winners breaking free from the Financial Matrix! GREAT JOB! 🙂 God Bless, Orrin

Lloyd weiler said

Wow, thanks for studying and making a complex issue so simple!! I respect and admire you for using your freedom to educate those who follow your leadership!

Andrew LaFleur said

Orrin,

I really appreciate the teachings of your blog and of the Life Leadership materials. Nothing has been more helpful in my life! I intend to continue this learning and do my best to spread it to as many people as I can!

Yet I have a dangerous curiosity: How does the elimination my debt and the building of my wealth help my country? What is the long term result of thousands or millions of us doing this?

Orrin Woodward said

Andrew, there are many reasons. First, debt-free people can afford their own opinions. Second, millions of debt-free people reduces the monetary multiplier of the Fractional-Reserve-Banking (FRB) system which is inflating away our money supply. Third, in any downturn someone who owns everything isn’t in danger of losing everything they use, but do not own. Fourth, having wealth in a any downturn (where prices are greatly reduced) allows those with wealth to buy resources for low cost as others fight to sell the little they own to pay off their inflated debts. Finally, it’s Biblical – “The borrower is slave to the lender” and we are not to owe anything to one another except love. 🙂 Hope that helps. thanks, Orrin

Turhan & Carol Berne said

That response to Andrew’s question was profound Orrin!!

Orrin Woodward said

Thanks Turhan and Carol. Keep leading and learning! 🙂 God Bless, Orrin

Andrew LaFleur said

I understand! Thank you! So, play well with the cards we are dealt and with many professional players, we may then be able to change the game?

Because fiat currency = fractional reserve banking = debt. In other words, if labor/time = $, then the creation of any money from nothing (at the Fed or the FRB) = labor and time that have yet to be generated (i.e. debt), correct?

Orrin Woodward said

Well said Andrew! 🙂

Dave Nelson said

think of all the wonderful choices we could make throughout our life IF we were not in debt. what if we were taught the blessings of entertainment through learning instead of entertainment through earning. When misfortunes comes how great it is not to have monstrous payments to make. I think Orrin’s bridging principle is right on. Our Savior is the bridge to the Father. Orrin helps us create another type of bridge that saves us from the evils of debt and financial ruin. both bridges lead us and others we help to a more fruitful life. Orrin, you should feel great for finding a way for people of any age to grow and gain control of their future.

Orrin Woodward said

Dave, Love the bridge. Jesus is the Spiritual Bridge to God. Our LIFE Leadership materials are the Mental Bridge to Education and our Financial Fitness Materials are the Physical Bridge to Financial Freedom on Earth! 🙂

Matt Foote said

Thanks so much, Orrin. This is another great reminder of the importance of the movement in which Life Leadership is leading the charge to defend Liberty through correct information.

Danny Kellenberger said

Orrin,

I do enjoy these blogs and learning and understanding more what is really going on behind the curtain. Thanks for enlightening us. I really appreciate the courage you have to stand up and share truth and principles. It emboldens me to do the same!

Carpe Diem

Theresa Zizzi said

Orrin, I have been studying The Life Leadership materials for several years and have experienced profound changes in all of my relationships: family, friends, and business. Your leadership training helped me go from earning $60/week to $60,000/year in 18 months! However, the biggest positive impact to my life occurred because of studying The Financial Fitness Program.

Two years ago I was put in the position of supporting myself. I took the FFP information to heart, paid off what debt I had, lived frugally, and saved as much money as I could. Five months ago I was injured at my job as a Housekeeper. Long story short, I found myself without a job 2 weeks later and no income. I was ineligible for any government support, my employers had no workers compensation, and I was too injured to work. Was I worried…..NO!! I had bought myself a recuperation period with my savings!😊 I tried to rejoin the workforce two months ago, but had a setback to my injuries. Guess what? Thanks to The FFP, I am happily enjoying my recuperation period…..again!!

I can’t even imagine the stress, fear, and hopelessness I would be feeling if not for Life Leadership and The FFP!

Unforeseen challenges strike us hard and fast, affecting us financially, emotionally, and physically. These unknown dangers can be faced with more surety of step if we but first know of and implement The FFP into our lives. Thank you to LIFE Leadership for taking out the “un” and making healthy financial literacy KNOWN!

Blessings!

Orrin Woodward said

Theresa, what an amazing testimony. If you haven’t already, we need to get your story included in the testimonials page of the Financial Fitness Program. I am very proud and impressed! 🙂 thanks, Orrin

Elaine Mallios said

Theresa is one amazing woman. During those dark days her faith never wavered. All I could think to do was feed her because I was so worried! Now lets build this team like never before – for Theresa and her children and for mankind.

Turhan & Carol Berne said

One again a very well written and profound blog. Orrin I thank you for continuing to educate us in an area where I am many others are uneducated!!

David Kangas said

Thanks Orrin! I love Life Leadership’s way of keeping things simple to understand and easy to implement (of course that’s a choice). My father once said that life is easy, it’s the poor decisions we make is what makes it difficult. Sooo true! 😃

Orrin Woodward said

David, Well said! The Bible teaches to strive after righteousness and wisdom. Sadly most strive after license and folly and reap what they sow. Life is tough enough with challenges outside of our control to then flub up the ones within our control. 🙂 thanks, Orrin

Rory Sayers said

Orrin, I’m sure this question will lead to more.

If all the assets have been acquired with the currency scam who ends up owning the property that was purchased with the fictitious money when the system collapses?

Are there any historical references to learn from? As far as I know this is the only time in history when all countries are on a debt based fiat system.

Orrin Woodward said

Titles are owned by those who have placed liens on the property; hence, the Big Bankers. 🙂

Rory Sayers said

So the cons get to keep the property they got for nothing. Where is the justice in that?

This can best be described as a game of musical chairs that the players who can’t sit down have had to pay for.

As it pertains to mortgages. The number of times it gets sold and divided into derivatives will make it impossible to know who actually is the owner. Ultimately this is going to lead to a major conflict.

Orrin Woodward said

Rory, if we can stop the music, then it will quickly right itself as people who produce will accumulate wealth and this who are parasites will die off, so to speak, or learn to produce. The free rides for non-performance will end on both sides because fiat money will no longer pad elites or the people who cannot (or will not) find work because of the manipulation of the money supply. Any course for society to take back property would lead to further injustices and would be doing evil so that good would occur. God will be the avenger, we must be the light in the darkness. thanks, Orrin

Rory Sayers said

Proverbs 16:19

Mike Bercier said

Great read first thing in the morning! The Financial Fitness Program has helped us get rid of consumer debt outside a mortgage! It’s only a matter of time and hard work before Life Leadership sets us free from the Financial Matrix!

Thomas Taylor said

Hi Orrin,

By applying the principles contained in Life Leadership’s “Financial Fitness” program it is possible for individuals to become debt free if applied properly. In doing this we can maintain a standard of living we have always wanted. My questions are these: Are we truly debt free? Isn’t the debt of our State and Federal governments actually the taxpayer’s debt? How will we as a nation be able to pay off our national debt? I am trying to make sense out of this absurd monetary system the aristocracy and governments we have created. If the federal government keeps printing “fiat” money and banks continue to loan money that physically does not exist, How are going to stop this spiraling and out of control monetary nightmare?

Orrin Woodward said

Thomas, one of the principles I have learned from life is to accept responsibility for you can change quickly and ask for grace for things that will take more time. 🙂 Getting debt free personally is an absolute personal responsibility while getting government and business to be more financially conservative is a social responsibility that can only occur once you have demonstrated you understand the concept personally. Thus, we need to drive personal change that, longterm, creates social change. thanks, Orrin

Steve Meixner said

Orrin, Another Great Post. This is information that is not available elsewhere. I am continuing to remove all Debt from my life. It is only because of this information that I have become Wise Enough to do so. My goal is to Owe nothing but my Mortgage by the end of 2016. Of course if my business goes fast enough that will be Eliminated also 🙂 Thank You,

Steve

Orrin Woodward said

Excellent Steve! 🙂

Tom Davis said

Thank you Orin for being more convicted to help your fellow man. You vision is what keeps me focused instead of running off to Intetnet Marketing as some others have done recently. It’s not about accumulateing wealth it is about making a diference in peoples lives.

Orrin Woodward said

Tom, Keep rocking big man. The reason “Purpose” is the first resolve is because the first question I ask is – Does this help or hinder me in fulfilling my purpose. God Bless, Orrin

Adam Kleinschmidt said

Orrin, great article. I’m selling a car I haven’t earned and using the proceeds to get out of a large lease payment also this move will eliminate $800 a month cancer.

I understand economically that a commodity backed currency would be the ideal to strive for, but we do have another choice to escape the fiat debt system that I haven’t seen Life discuss yet. A virtual currency like Bitcoin has some amazing properties as an independent from government currency and has certainly got some traction. It could easily be accepted as a payment method at life. Has the policy counsel discussed this as an option in the future possibly?

Orrin Woodward said

Adam, I am still doing research; however, I am concerned that anything that man creates, he can create more of. The reason gold and silver have worked through the millennia is because man cannot make these items without spending more than the commodity is worth. If they ever can create gold or silver cheaper then we would be in some trouble. 🙂 Bitcoins is a cool idea, but the old saying figures don’t lie but liars sure can figure would lead some elite group to seek control over the quantity of bitcoins and we are back to money supply manipulation in its newest form. 🙂 thanks, Orrin

luke said

Ill follow you to the ends of the earth Orrin…

One day i want to be as great as a leader as you are

Christopher Wild said

Orrin, your vision is beyond huge. I, for one, am extremely thankful for the continued learning you do not only to bless us with more information with which to research on our own and serve others, but also as an example of a fantastic, wise leader to chase.

Malissa said

We’ve done Christmas in cash since we started working with Life and each year I would feel inferior and cheap compared to the rest of our family. We only give gifts we can pay cash for and again this year, we went to the family gathering, and again, as I feared, they bought my husband, myself and our three kids expensive things, with price tags attached. When we got home, I told my husband how I felt, that there is no way I can “compete”. That word I said, made me realize something. That is exactly how the financial matrix wants us to feel. That we are supposed to compete with our families, not give a gift with personal meaning that doesn’t put us into financial bondage for the next year. One family member showed us the brand new wedding set she bought herself (because she could afford the monthly payment) and she proceeded to tell me how good the credit company was, and how easy they are to work with. The Internet website that she used to get her ring, that sold her on bondage, got free advertising, and she got debt.

Orrin Woodward said

Malissa, this is so true. The Financial Matrix has captured Christmas and made it more about expensive gifts than love and time with family and friends. Regardless, we must break the cycle by setting a new bar and new example! 🙂 You guys are on the right track! God Bless, Orrin

David Kangas said

You rock Malissa! Sometimes our biggest battles come from the ones closest to us. Keep fighting the good fight!

J.R. Vander Weide said

Why not post all the LIFE resources online, so people can access it for free? but if someone wants the physical item they can order it?

If you see it as your God given responsibility to get the information out to people, then wouldn’t it make sense to do it the cheapest way possible so as to be a better steward of God’s money?

Orrin Woodward said

J.R., why not you do it with the resources God has given you and see if that works. I work with numerous charities and they seem to alway come back to handouts do not work, but only hand ups. If you can make it work, then you will be the first I have heard. To strengthen anything it takes resistances and effort and to become a leader one must invest, focus and overcome. thanks, Orrin

J.R. Vander Weide said

I don’t need to try it;) My tax dollars pay for the biggest failed charity ever ……. Welfare.

Thanks for the answer.

Orrin Woodward said

Excellent insight. Something for nothing destroys character while sacrifice for something builds it. Keep rocking J.R.!!!

Kyler Westerfeldt said

Some of the numbers don’t match too well, but here’s numbers from the Federal Reserve Bank. However, still a doubling of currency in circulation in 20 yrs. http://www.federalreserve.gov/paymentsystems/coin_currcircvolume.htm

Orrin Woodward said

Kyle, this is merely what the Federal Reserve produced out of thin air, remember this must be multiplied by the FRB system which is another ten times and then there are those pesky CDO’s (Collateralized Debt Obligations) which allowed banks to take the debt off their books entirely and then start FRB all over again. Here is the chart of the actual increase in money. The increase was so great the the Federal government finally stopped reporting M3 because it was out of control. thanks, Orrin

https://orrinwoodwardblog.com/wp-content/uploads/2015/12/Fed_1_StLouisMonetaryBase.jpg