LIFE Leadership: Financial Matrix Scam

Posted by Orrin Woodward on May 23, 2016

Did you know that fifty percent of all American workers are Financial Slaves! Don’t believe me? I don’t blame you, I could hardly believe it myself until I started doing my own

Did you know that fifty percent of all American workers are Financial Slaves! Don’t believe me? I don’t blame you, I could hardly believe it myself until I started doing my own

research. According to the latest data reported on Economist.com, over half of all Americans over 18 have no net worth, not even a penny. Let that sink in for a moment. Imagine all the hours husbands and wives work every year and over half of the households have NOTHING to show for it? The Broke Quadrant has no ownership and no choices, which is simply slavery under a different name.

Furthermore, over 80% of Americans over age 18 are in debt, a debt trapping them into financial status. For if the typical family loses one of its jobs, be it by downsizing or medial challenge, the family boat is capsized. This makes the family subject to the whims of employers and health – not a good position to be in. Is this really the American Dream we imagined growing for people living in the home of the brave and the land of the free? BTW, for the Canadians reading this, the data is very similar and the Financial Matrix has trapped your nation as well.

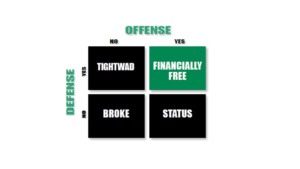

The two groups getting hammered by the Financial Matrix Scam are the Financial Slaves (no net worth) and the Financial Status (servicing debt to survive). The other sub-optimized quadrant is the Tightwad quadrant, where people live within their means by saying no to their dreams for decades. Who wants to do that? Indeed, the only quadrants that allows you to live your dreams without debt in a reasonable time-frame is the Financially Free quadrant, those who play Defense and Offense to escapt the Financial Matrix.

The two groups getting hammered by the Financial Matrix Scam are the Financial Slaves (no net worth) and the Financial Status (servicing debt to survive). The other sub-optimized quadrant is the Tightwad quadrant, where people live within their means by saying no to their dreams for decades. Who wants to do that? Indeed, the only quadrants that allows you to live your dreams without debt in a reasonable time-frame is the Financially Free quadrant, those who play Defense and Offense to escapt the Financial Matrix.

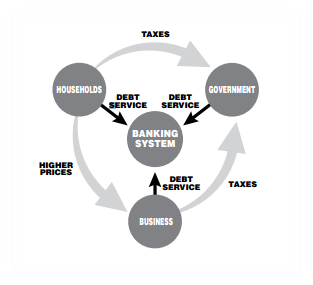

Escaping the Financial Matrix, in other words, isn’t a little deal. Instead, its one of the greatest accomplishments a person can achieve financially. The Financial Matrix is siphoning trillions of dollars from unsuspecting debtors at the household, businesses and government levels. In the video below, I share how to move from suboptimized quadrants and to Financial Freedom through applying the principles in the Green Box, The Financial Fitness Program. Only the Financially Free citizens have both ownership and the choices to live their dreams.

Although everyone can be free by learning how to play defense and offense to escape the Financial Matrix, it takes discipline to do so. This is where the Green Box community comes in, for it teaches people how to hold themselves accountable to their goals and dreams through Association, Accountability, and Acclamation. Community, in other words, is the key to the Green Box Revolution!

Watch the video below and determine where you fit within the Financial Matrix Quadrants and what your plan is to escape is. If you don’t have a workable plan, perhaps the Financial Fitness Program can help.

Sincerely,

Orrin Woodward: Life Chairman of the Board

29 Responses to “LIFE Leadership: Financial Matrix Scam”

Sorry, the comment form is closed at this time.

rick amdahl said

Truth.. thanks Orrin.

Steve Duba said

Thanks Orrin. Great job on putting this together. We will leverage the daylights out of it. Tell the team at headquarters they did a fantastic job. God speed brother.

Bob Rasmussen said

Thx O! I’m convinced you are spot on with the Financial Matrix causes and cures!! Thx for taking the time to study and root out the truth. Most importantly offering us all a real time solution. God Bless

Brandon J Perry said

Orrin,

Really loved this talk and the clarity you showed in teaching it. Thank you for studying this information and making it available to all of us.

Mary Schulman said

Brilliant! I am so grateful to be a part of this organization.

Eric Gladson said

Orrin,

Thank you for this genius diagram and for helping us see the financial matrix for what it is… A big scam from the banks!! Keep up the good work!

GILLES said

Magnifique démonstration de vérité…

MERCI BCP ORRIN

Greg Johnson said

Another money view to help explain the financial dilemma.

Excellent!

Elaine Mallios said

Don’t you love the diagram?!

Jim Wilson said

Thank you, Orrin once again. You have outlined the story of my childhood. I will shortly be 75, so I really watched the financial Matrix unfold. My dad contracted polio when I was 10 years old and the oldest of 5. That was 1951 and a time when people still help people. The Georgia Tech Alumni Association actually built a vey nice new house for my family to accommodate the 5 kids. Some years later my mom was not happy with the house they owned free and clear, so they sold the house and bought a new brick house. And subsequently they could not pay for it and they lost that house and ended up living in a cramped apartment. The financial Matrix is absolutely real.

Ken Hendon said

Good grief!

Joel said

Thank you as always, Orrin. If you don’t mind, I’d love to share this on my facebook page.

We need to end the fed. That’s all there is to it. We need to go back to sound money.

Orrin Woodward said

No problem. Share away. 🙂 thanks, Orrin

Kevin Rex Heine said

So, Orrin, here’s my question: Financial Sovereignty is ≈1% of the population, according to your example in the video. How, if at all, does that relate to the ≈5% who are financially independent “pipeline builders” in Robert Kyosaki’s Cashflow Quadrants? Are the financial sovereigns the ≈⅕ of the financially independent who are truly wealthy, or should the percentages for financial serfdom and financial sovereignty be adjusted some? (Should Financial Serfdom ≈ 15% and Financial Sovereignty ≈ 5%?)

Orrin Woodward said

Kevin, 4.6% of Americans are millionaires and the average income is just over $110,000 per year. Kiyosaki is saying anyone who is a millionaire is – the 5% – a B Biz owner, but actually most are Serfs that have saved enough money to have ownership without all the choices unless they want to go into debt. I researched the data and 50% of Americans have no net worth, 80% are in debt and out of the 20% who are free on 4.6% are millionaires (which means a million dollar net worth). Of course, if you own a house outright that is worth 500k then you wealth is illiquid and you are a SERF not a SOVEREIGN. Simply put, very few households have both ownership and choices because choices requires cashflow without having to go into debt. 🙂 thanks, Orrin

Kevin Rex Heine said

So, then, there’s some overlap between Kiyosaki’s definition of “financial independence” (the “B” and “I” on the Cashflow Quadrants) and your definition of “financial serfdom.” As I understand your explanation, the overlap consists of the four-of-five who are financially independent, but don’t have enough liquid assets to have the financial freedom of choice necessary to be a financial sovereign. Does that accurately paraphrase your explanation?

Orrin Woodward said

Correct, and also the 4.6% of millionaires are not all debt free either. There are several overlaps because net worth is not the same as Financial Sovereign. A person could be a multi-millionaire on paper and yet still be a Financial Subject. Thus, between some millionaires being Serfs and some Subjects, only a few truly have ownership and cash flow sufficient to have practically unlimited choices on vacations, second homes, etc and pay cash for all. 🙂 That’s why Financial Sovereigns are rarer than millionaires. Banks LOVE in debt millionaire Subjects. 🙂 thanks, Orrin

Kevin Rex Heine said

Interesting. I had always been under the impression that, to be financially independent, one had to: (a) be personally debt-free, and (b) control a debt-free B-type or I-type marketable asset that could be used to generate residual income/cashflow. I had somehow missed the note that one had to be a millionaire as a prerequisite to being financially independent (a position that I absolutely reject).

Quite frankly, given that multi-millionaires can still be financial subjects (due to debt burden), it seems to me that the Cashflow Quadrants and Financial Matrix concepts are more loosely connected than I originally thought. (I am still trying to wrap my head around the notion that financial independence and financial subjugation are somehow not mutually exclusive concepts.)

Orrin Woodward said

Kevin, I personally know 10 former multi-millionaires, who claimed to be B-Business owners, yet also had debt loads. Of course, once the incomes stopped, so did the lifestyle, and all the things they “owned” were returned to the banks. Believe what you want, but the facts are if you owe money, then you are at risk of losing your “assets” because the banks will get their pound of flesh. To treat debt as an asset is like treating cancer as health in the body. You cannot lose an asset you own free and clear and when my income dropped to 10% of what it was for a couple of years (2008-2010), Laurie and I lost nothing (outside of our savings) because we owned all our assets free and clear. 🙂 A B-business owner only refers to how a person plays offense, not defense. When you include defense, he may be a Serf, Subject or Sovereign, it all depends on how they apply the defensive strategy to the excellent B-Biz Offense. thanks, Orrin

Kevin Rex Heine said

The only “belief” that I’ve actually stated in this conversation is that I reject the assumption that one must be a millionaire in order to be financially independent. I say that because I think that, if one plays defense properly, then financial independence (and even financial sovereignty) can be accomplished on less than $1,000,000 net worth.

That said, I now understand that the Cashflow Quadrants model refers only to the offense side of the Financial Matrix model . . . which is only half the total picture. And, honestly, I wish I’d known this thirty years ago.

Orrin Woodward said

You got it Kevin. I think that is the key distinction between the Financial Matrix Quadrants and the Cash Flow Quadrant, namely, the Financial Matrix capture the entire financial picture (offense and defense) rather than just offense in Kiyosaki’s model. Have a great night. 🙂 thanks, Orrin

Danny Kellenberger said

Thank you Orrin for presenting this information in such a simple, visual way. While it is sobering, it is truth. And it needs to be taught. #lovelifeleadership

Carpe Diem

adam beussman said

Great video and a different way to see the financial matrix

CJ Calvert said

Amazing explanation Orrin, thanks for sharing

Travis said

Thanks for putting this together Orrin. I’ve always appreciated the difficult topics that you’ve simplified.

Travis

Ross Goldsmith said

Thanks for putting this in terms everyone can understand!

Larry said

Thank you Orrin for your insight!!

Elaine Mallios said

So cool! Like the diagram. Took me a few times and a magnifying glass! (for the percentages) Got it! Thanks.

Shane Krauser said

Orrin, you have really amplified an awakening for me in this intense focus on the financial matrix. While the political circus rages on, real solutions are offered through your simple four-quadrant diagram that, if understood, can create real liberation all over the world. Thanks for this great post!