Updated: After finishing Too Big to Fail by Andrew Sorkin, I had to update this post!

If the 1989 breakup of the Soviet Bloc countries didn’t humble all the Keynesian economists, then the 2007 credit-crisis finished the process. The Keynesian economists were confronted, yet again, with the difference between economic law and the fallacies bandied about in their numerous textbooks.

First, the Keynesians, with the communist bloc in near starvation, learned that communism didn’t work – something Mises had pointed out eighty years previous. Mises irrefutable theoretical answers – he proved that without a free market there was no price system; therefore, no economic calculations were possible – are now confirmed with hard data from the numerous failed communistic nations. China, shockingly, has more economic freedom than the United States today! This is what happens when America continues to dabble in Keynesianism (socialism light) and China, in an effort to improve results, rejected hard-line communism in favor of free-enterprise concepts. The world truly has been turned upside down. 🙂

Second, the Keynesians learned the banking system is a “house of cards,” surviving on a “confidence game,” where only the insiders know how highly leveraged the banks truly are. Without the $1.1 trillion bailout (TARP) from the USA government, the banking system would have “dominoed to destruction” – Bear-Stearns to Lehman Brothers, to Merrill Lynch, to AIG, to Morgan Stanley, even Goldman-Sachs was on the precipice before TARP. Andrew Sorkin’s book Too Big To Fail provides the reader with a front row seat and play-by-play descriptions of the events during the 2007-08 credit-crisis.

Third, and a preview of coming attractions, the Keynesians will learn that even all-powerful governments must obey economic law. They will witness a government “domino to destruction,” similar to banking systems near collapse; however, the governments have no one to backstop their violations of economic law and the collapse will be on a much greater scale. In other words, the government bailouts only delayed, rather than killed, the day of reckoning. The highly-linked leveraged debt dominos between countries are set up in precarious fashion. It will only take one country (Greece anyone?) to renege on its payments causing the next weakest country to follow suit, leading eventually to a world-wide economic collapse of the highly leveraged governments.

For the overly taxed citizens, “Humpy-Dumpty’s” fall will upset the markets and livelihoods in the short term. But, over time, it will free citizen leaders to create market-place solutions, rather than submit to the unworkable Statist-Keynesian global mindset. Essentially, history will teach the Keynesian that their measures were the problem, not the solution as advertised. Only a few voices, mainly Ludwig Von Mises with a nod to Friedrich Von Hayek, predicted the cycle of inflationary spending in the early twentieth century! Truth, in other words, was right under the global powers noses over 100 years ago, but it was denigrated because it went against their desire for FREE money and increased Statist’s control. I wrote about this in my book RESOLVED: 13 Resolutions for LIFE on how the whole credit-crisis is symptomatic of a bigger issue: the character-crisis.

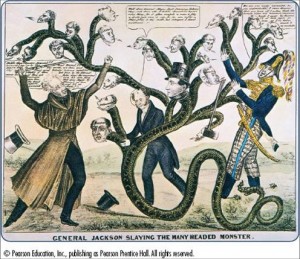

Remember, when the Big Banks and Big Government first proposed taking over our nations money system, it was to eliminate the credit cycles; however, truth be told, it didn’t eliminate cycles, but only delayed them, making the waves bigger and the destruction greater when they finally crash upon the economy. Thankfully for the modern power-pundits, the masses remain ignorant of the Federal Reserve’s dismal track record. Unaware of the danger, the people’s lethargy is the power-brokers’ best security, allowing the inflationary money scam to consistently rob the producers for the benefit of the exploiters.

Indeed, it must be asked: why doesn’t anyone stand for truth in today’s modern age? I believe a huge part of it is that few people believe in truth anymore, and of the few who do, few are willing to do the heavy mental work involved to learn it. The goal of the Mental Fitness Challenge is to awaken people to the need for personal development and developing a foundation in which to learn, apply, and change oneself. Here is a fantastic article on Mises by Mark Spitznagel.

Sincerely,

Orrin Woodward

Ludwig von Mises was snubbed by economists world-wide as he warned of a credit crisis in the 1920s. We ignore the great Austrian at our peril today.

Mises’s ideas on business cycles were spelled out in his 1912 tome “Theorie des Geldes und der Umlaufsmittel” (“The Theory of Money and Credit”). Not surprisingly few people noticed, as it was published only in German and wasn’t exactly a beach read at that.

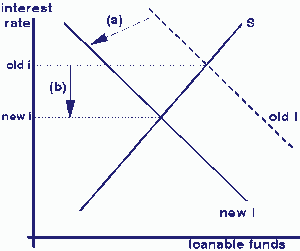

Taking his cue from David Hume and David Ricardo, Mises explained how the banking system was endowed with the singular ability to expand credit and with it the money supply, and how this was magnified by government intervention. Left alone, interest rates would adjust such that only the amount of credit would be used as is voluntarily supplied and demanded. But when credit is force-fed beyond that (call it a credit gavage), grotesque things start to happen.

Government-imposed expansion of bank credit distorts our “time preferences,” or our desire for saving versus consumption. Government-imposed interest rates artificially below rates demanded by savers leads to increased borrowing and capital investment beyond what savers will provide. This causes temporarily higher employment, wages and consumption.

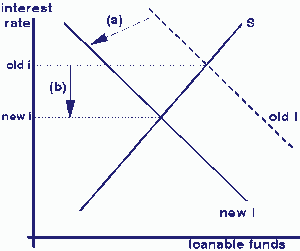

Ordinarily, any random spikes in credit would be quickly absorbed by the system—the pricing errors corrected, the half-baked investments liquidated, like a supple tree yielding to the wind and then returning. But when the government holds rates artificially low in order to feed ever higher capital investment in otherwise unsound, unsustainable businesses, it creates the conditions for a crash. Everyone looks smart for a while, but eventually the whole monstrosity collapses under its own weight through a credit contraction or, worse, a banking collapse.

The system is dramatically susceptible to errors, both on the policy side and on the entrepreneurial side. Government expansion of credit takes a system otherwise capable of adjustment and resilience and transforms it into one with tremendous cyclical volatility.

“Theorie des Geldes” did not become the playbook for policy makers. The 1920s were marked by the brave new era of the Federal Reserve system promoting inflationary credit expansion and with it permanent prosperity. The nerve of this Doubting-Thomas, perma-bear, crazy Kraut! Sadly, poor Ludwig was very nearly alone in warning of the collapse to come from this credit expansion. In mid-1929, he stubbornly turned down a lucrative job offer from the Viennese bank Kreditanstalt, much to the annoyance of his fiancée, proclaiming “A great crash is coming, and I don’t want my name in any way connected with it.”

We all know what happened next. Pretty much right out of Mises’s script, overleveraged banks (including Kreditanstalt) collapsed, businesses collapsed, employment collapsed. The brittle tree snapped. Following Mises’s logic, was this a failure of capitalism, or a failure of hubris?

Mises’s solution follows logically from his warnings. You can’t fix what’s broken by breaking it yet again. Stop the credit gavage. Stop inflating. Don’t encourage consumption, but rather encourage saving and the repayment of debt. Let all the lame businesses fail—no bailouts. (You see where I’m going with this.) The distortions must be removed or else the precipice from which the system will inevitably fall will simply grow higher and higher.

Mises started getting some much-deserved respect once “Theorie des Geldes” was finally published in English in 1934. It is unfortunate that it required such a disaster for people to take heed of what was the one predictive, scholarly explanation of what was happening.

But then, just Mises’s bad luck, along came John Maynard Keynes’s tome “The General Theory of Employment, Interest and Money” in 1936. Keynes was dapper, fresh and sophisticated. He even wrote in English! And the guy had chutzpah, fearlessly fighting the battle against unemployment by running the currency printing press and draining the government’s coffers.

He was the anti-Mises. So what if Keynes had lost his shirt in the stock-market crash. His book was peppered with fancy math (even Greek letters) and that meant rigor, modernity. To add insult to injury, Mises wasn’t even refuted by Keynes and his ilk. He was ignored.

Fast forward 70-some years, during which we saw Keynesianism’s repeated disappointments, the end of the gold standard, persistent inflation with intermittent inflationary recessions and banking crises, culminating in Alan Greenspan’s “Great Moderation” and a subsequent catastrophic collapse in housing and banking. Where do we find ourselves? At a point of profound insight gained through economic logic, trial and error, and objective empiricism? Or right back where we started?

With interest rates at zero, monetary engines humming as never before, and a self-proclaimed Keynesian government, we are back again embracing the brave new era of government-sponsored prosperity and debt. And, more than ever, the system is piling uncertainties on top of uncertainties, turning an otherwise resilient economy into a brittle one.

How curious it is that the guy who wrote the script depicting our never ending story of government-induced credit expansion, inflation and collapse has remained so persistently forgotten. Must we sit through yet another performance of this tragic tale?

Mr. Spitznagel is the founder and chief investment officer of the hedge fund Universa Investments LP, based in Santa Monica, Calif.