“The trouble with paper money is that it rewards the minority that can manipulate money and makes fools of the generation that has worked and saved.” – George Goodman

The philosopher’s stone was mankind’s quest to turn base metals into gold. Although there were several reasons for the quest, the main one was to increase the power of the sovereigns over their people. Kings and princes encouraged and rewarded alchemists from the Middle Ages to the end of the 17th century in the effort to discover the philosophers stone to no avail. Unfortunately, however, mankind discovered an easier way to turn valueless material into gold, namely fiat paper money and fractional-reserve banking. I cover the basics of these two processes in my book The Financial Matrix, but I wanted to share from Jack Weatherford’s informative book The History of Money to convey just how confused most people are about money. These are blue quotes are from Weatherford’s book with my comments below. Sincerely, Orrin Woodward – LIFE Leadership Chairman of the Board

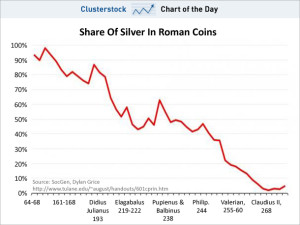

Nero Debases Roman Coins:

Nero began to tamper with the coinage itself. In A.D. 64, in a naive attempt to deceive the populace, Nero decreased the silver content in the coins and made both the silver and gold coins slightly smaller. By collecting the existing coins and reminting them with his portrait bust but less silver, Nero produced a momentary surplus of sliver and gold. The same pound of silver that had formerly produced 84 denarii now produced 96, giving Nero almost a 15 percent ‘profit.’ He similarly increased from 40 to 45 the number of golden aurei manufactured from a pound of gold, thus rendering the coins about 11 percent less golden.”

Nero attacked private property by manipulating the measuring scale of money. Instead of a certain amount of silver making 84 denarii coins, it now made 96 denarii coins. The measure of how much silver in each coin was arbitrarily changed by the sovereign. This attack on private property is no different than the State owing a certain merchant 100 pounds of gold, and then paying the merchant only 50 pounds of gold. When the merchant complains, the State points to a new law that has changed the pound to half its former weight. Therefore, the State did pay 100 pounds of gold, but changed the definition of the pound to steal half the value of amount owed. In a sense, the State debased the weight of the pound just as Nero debased the denarii coins.

Law of Inertia: If Bad Behavior is not Punished, it Expands:

Thus over the course of two hundred years, the silver content was cut from nearly 100 percent to virtually nothing. The amount of silver previously used to mint a single denarius eventually produced 150 denarii, and as the silver content decreased, the price of good increased in direct proportion. Wheat that had sold for one-half a denarius in the second century increased to 100 denarii a century later, a two-hundred fold increase.

If the State is allowed to arbitrarily change the monetary units at will, inflation occurs and the price system quickly accounts for the debased purchasing power of the monetary unit. The State receives the benefit of the inflated money first, but they do so at the expense of later users of the money who now need more monetary units to buy the same production as previous. This is fraud perpetrated by the State upon society and one of the main reasons Rome fell. The people lost trust in the money supply because the State could not stop debasing the dollar to benefit itself. Accordingly, the late Roman empire devolved backwards to payment in kind and landlords protecting people rather than State. Once this occurred, society could no longer support the bloated State and the Roman Empire collapsed under its own weight.

The Roman Empire Kills Its Money:

In the last centuries of the Roman Empire, the emperors operated without a workable currency; like the ancient empires that had preceded it, Rome turned to conscription and forced labor to meet its needs. The government often would not allow its citizens to pay taxes in the debased money that it still issued; instead, officials demanded payment in good, crops, or labor. . . As tax (and monetary) policies continued to suppress productivity and commerce, the emperors found it increasingly difficult to supply their armies and the bureaucracy with the equipment and goods necessary to rule the far-flung but diminishing empire. The markets had withered; even the emperor could no longer depend on the open market to supply him with the sandals, armor, weapons, saddles, tents, and other goods that an army needed. Out of desperation, Diocletian created government-sponsored workshops to manufacture armaments and supplies. As privately financed shipping and other transport enterprises declined, Diocletian also had to create government transport companies to move the goods that were manufactured in the workshops. Well before the end of the third-century, these changes made the emperor and the government the greatest manufacturers in the empire, in addition to being the largest owner of land, mines, and quarries. Step by step, the imperial government took over the direct administration of the economy and crowded out the small, independent merchants, landowners, manufacturers, and entrepreneurs. . . By its last decades, Rome had become another state-administered economy, an empire without money and markets. It had reverted to a palace system more like that of pharaonic Egypt or imperial China than that of the republican system on which it had been built.

Rome fell because as the State expanded, it destroyed the monetary system and thus the commercial system that used it as the medium of exchange in trade. Through increasing inflation and taxation the State killed society to feed the growing bureaucracy and military. The originally thriving Roman society provided a level of systematic justice unknown to previous empires eventually became just like the other empires as it killed the monetary system through repeated unjust debasements and the commercial society reverted to a command and control empire without money. The Roman Empire died, in other words, when its money did.

Fractional-Reserve Banking is Fraud:

Under the new system a bag of a hundred florins that might once have sit idle for years in a noble’s strongbox could now be deposited for safekeeping in an Italian bank that had access to branches across the continent. The bank then lent the money and circulated the bill of exchange as money. The noble still had his one hundred florins, which were now one deposit in the bank; the bank had one hundred florins on its books. The merchant who borrowed the florins was richer, and the person who held the bill of exchange now had one hundred florins as well. Even though only one hundred gold coins were involved, the miracle of banking deposits and loans had transformed them into many hundreds of florins that could be used by different individuals in different cities at the same time. This new banking money opened vast new commercial avenues for merchants, manufacturers, and investors. Everyone had more money: it was sheer magic.

Actually, it is not sheer magic, but sheer fraud. In a nutshell, the banks creates a metaphysical representation (bank notes) of the actual money (precious metal commodity florins). This would be fine if there was only one banknote to represent the same commodity money, but fraudulently, the banks through FRB create multiple sets of banknotes to represent the SAME bag of florins. This is no different than a bank selling 10 people the same physical property by creating 10 separate metaphysical property titles to represent the land. Of course, in the property example, the fraud would be exposed because the owners would eventually show up at the property and realize, along with the the other “owners” of the property, that they were duped by duplicate property titles created for the same physical property. In the same way, the bank creates duplicate banknotes to represent the same physical commodity money. This is FRAUD. In the banknote example, however, all parties can use the banknotes representing the same bag without being aware that the others also have banknotes that represent the EXACT same physical bag of money.

Of course, this violates the laws of Logic. For two people cannot 100% own the same item at the same time and two people cannot be in the same spot at the same time. In a similar fashion, two people (let along 9 or 10 than FRB legally allows) cannot both have banknotes that metaphysically represent the same bag. Because this “magic” (read fraud) is allowed, the money supply is expanded metaphysically even though the physical money hasn’t changed size, just like the land was metaphysically expanded by the fake titles even though the physical land has not changed. Unfortunately, the scam is rarely detected because the banknotes are just transferred from person to person without anyone realizing their are counterfeit not not backed by real commodity money. The result is huge bank profits, huge societal inflation, and indebtedness for governments, businesses, and people. Of course, another result is the predictable boom/bust cycle that bankrupts many others when the money supply deflation from its previous inflation.

Fractional-Reserve Banking (FRB), in other words, is modern man’s solution to the Philosopher’s Stone. Add to it the Central Banks special privilege to purchase items by creating banknotes not backed by anything and one can see that the modern day elites have accomplished what the middle-age kings and princes only dreamed of – creating fools gold, but having the legal right to pass off fool’s gold as real gold and enslave the people in the process. The is the Financial Matrix! Like I said previously, the modern golden rule reads: He who controls the fool’s gold controls the fools.