I am reading a fascinating book on the Federalist Era by John Miller as part of my new book for LIFE Leadership. Miller does a great job of showing the strengths of both the Federalist and anti-federalist positions. The Federalist wanted a consolidated government to end state induced chaos. This was the right course, but in their haste to ratify the Constitution, they permitted the Power Pendulum to move further into coercion than most understood. In fact, the Federal government immediately began usurping sovereignty from the states beyond its written limits. Sadly, this dispute between those who supported Federal sovereignty and those who supported state-sovereignty was not resolved until America’s Civil War.

What is surprising to me is that the issues fought over during the Civil War were clearly present as early as 1790! In fact, Alexander Hamilton, the leader of the US treasury, drove three key issues through Congress – Debt Assumption, The US Bank, and Protective Tariffs – that were all designed to move power from the states into the Federal government. Let’s study the history and see what leadership lessons we can learn from the Founders experiences. Here is Historian John Miller’s explanation of Hamilton’s vision:

Federalist Alexander Hamilton on Government

In they heyday of their power under the Articles of Confederation, some states had assumed part of the federal debt. Now, in 1790, Hamilton proposed to turn the tables by assuming the state debts. As he visualized it, such an assumption would serve as a double-edged sword with which to strike at the roots of state sovereignty. In the first place, it promised to bring within the orbit of the Federal government all the state creditors, the most influential part of the community; secondly, it would relieve the states of the necessity of levying taxes, for if the Federal government took upon itself the payment of all the debts, it must perforce have all the revenue – and possessing the whole revenue it came into possession of the whole power of the Union. Deprived of the support of their wealthiest citizens and unable to exert their authority by means of taxation, the states, Hamilton fondly imagined, would gradually wither away and their strength would be absorbed by the Federal government.

Interestingly, Patrick Henry predicted the North’s banking and manufacturing interests plan of action during the Virginia ratification debates. He outlined the North’s plan for consolidation of the states into the Federal government well before the Constitution was ratified when he argued, “Not satisfied with a majority of legislative councils, they must have all our property. . . This is a contest for money as well as empire.” Henry, surpassed all the other founders in his knowledge of human nature. He intuitively understood that human beings run governments; therefore, governments cannot be given absolute power without endangering the life, liberty, and property of society’s members. In the Founders haste to ratify the new Constitution, few, if any, stepped back from the precipice to ponder why one of the greatest leaders of the recent revolution was against the Constitution. Indeed, had they truly listened to the Anti-Federalist main issues, American history would be radically different. Unfortunately, one of life’s key lessons is that one cannot beat something with nothing. Although Henry clearly delineated the Five Laws of Decline opening within the proposed Constitution, he did not offer a viable alternative.

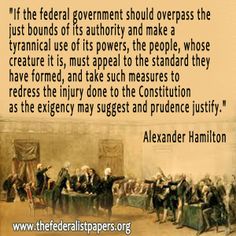

In consequence, shortly after the Constitution was ratified, the issues Henry pointed out reared their ugly head within Congress. John Miller wrote, “In November, 1790, the Virginia legislature sent a Protest and Remonstrance to Congress in which assumption (of the state debts) was pronounced to be ‘repugnant to the Constitution of the United States’ and the funding (protective tariffs) system ‘dangerous to the rights and subversive of the interest of the people.’” Alexander Hamilton was upset at Virginia’s state-rights stance and responded accordingly as Miller wrote, “This development strengthened Hamilton’s conviction that a decisive showdown struggle between Virginia and the national government was inevitable, ‘This is the first symptom of the spirit which must either be killed or it will kill the Constitution of the United States,’ he told John Jay. Instead of sympathizing with Hamilton’s eagerness to force a showdown upon Virginia, Jay advised him to wait for the healing effects of time and statesmanship to demonstrate the benefits of the Constitution.’”

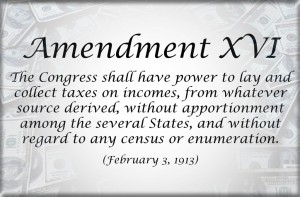

As a result, the main undercurrents of the issues that led to open conflict in the Civil War – slavery, Federal usurpation of state sovereignty, and the unfair distribution of taxes and rewards (tariff and National Bank stocks) – were at work by 1790. Since Jay believed that time was on the Federalist side and eventually would overcome state resistance, Jay counseled Hamilton to pursue his policies with caution and patience (not an easy course for the aggressive Hamilton). Disastrously, however, time did not heal the riff between the North and Sought. Indeed, both sides rejected compromises and the injustices mentioned above continued until the Civil War ended slavery. Because the Founders did not address and resolve the inconsistencies inherent within the Constitution, their sons and grandsons died in droves in the Civil War fulfilling Hamilton’s prophecy as Miller wrote, “While Hamilton reluctantly agreed to hold his hand, he was never persuaded that there was any permanent solution to the problem short of carving up Virginia and other large states in smaller jurisdictions.” This is exactly what occurred in the Civil War when West Virginia separated from Virginia. Unfortunately, the others (Federal control over states, central banking, and oppressive taxation) were not ended. In fact, the Federal government invented new forms of tyranny as their funding grew and the realism of the anti-Federalist proved more accurate than the the idealism of the Federalist. American oppression grew to levels inconceivable by even the most fearful of anti-federalist.

The genius of Alexander Hamilton was to recognize the incompatibility between a nation with divided sovereignty. True, a nation can divide the spheres of sovereignty, but it cannot have two parities (Federal and states) responsible for the same sovereignty issues. Hence, the Constitution was created with the seeds of its own destruction. Curiously, the American Founders, although they studied the Roman Republic extensively, missed the main lesson to be learned from them. Indeed, the Roman Republic failed because of the divided sovereignty issues between the people supported Tribunes and the aristocratic Senate supported Counsels. They both, in essence, attempted to lead Roman society and the political conflicts eventually led to civil war. In the Roman Republic’s example, Caesar resolved the conflict in the people’s favor against the Senate. Strangely, America followed a similar course in its divided sovereignty issue between the states and federal government. The political conflicts of 1790 were resolved in America’s Civil War of 1860 when Lincoln settled the disputed sovereignty in the Federal government’s favor. In both instances, the republics ended and the empires began.

I believe the main leadership lesson to learn from the above is that one cannot leave issues unsettled to pass onto the next-generation. Leaders address and resolved issues – that is what they get paid to do. Hence, when issues arise, one cannot pass the buck, hoping some leader in the future fixes the issues. In essence, this is why I created LIFE Leadership because I am sick and tired of watching America’s future be mortgaged through excessive government spending and borrowing at the expense of liberty, prosperity, and integrity. Leaders cannot sit back and wait for others. Instead, they must change themselves so they can play a part in changing society. What part will you play?

Sincerely,

Orrin Woodward