In my continuing research for my new book, I read a fascinating book on the history of free banking by Larry Sechrest. Mr. Sechrest describes how free banking between competitive banks can end the centralist planning cartel known as Federal Reserve System in America. Although the lessons of the failed centralist planners from Eastern European states are available for all to study, it appears these lessons were swept under the rug, especially when monetary policy is the topic of discussion.

Why is this? Simply put, the direct power over the money supply is the indirect power over the people. For in modern capitalistic societies, every member uses money to produce, trade, and consume. Thus, when the money supply is surrendered to the State and its cronies, so too is the financial liberty. Thomas Jefferson recognized this fact during the 1809 debates for the re-charter of the Bank Bill, “If the American people ever allow private banks to control issue of their currency, first by inflation, then by deflation, the banks and the corporations will grow up around them, will deprive the people of all property until their children wake up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

Strangely, Americans spends millions of dollars and endless hours to elect officials that can do little more than follow the counsel of the monetary central planners. Proverbs 22:7 states the politicians subservient condition, “Just as the rich rule the poor, so the borrower is servant to the lender.” Therefore, since one of the keys to great leadership is majoring on the majors, when one understands the Five Laws of Decline, he will quickly realize the power and control surrendered to the centralist planning cartel over the American monetary system is the major of major issues.

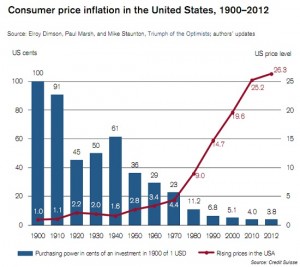

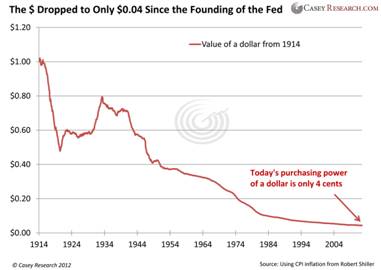

In order for this to change, the people must educate themselves on viable alternatives to the current oppressive system. Indeed, the famous political dictum – you cannot beat something with nothing – is why America has suffered through endless devaluations of its currency to where a 1913 dollar is now worth four cents. As I write this, three words come to mind – unbelievable, unconscionable, and unsustainable. Free banking is the free market alternative to central planning plunder. LIFE Leadership is on a mission to learn truth in an age of growing lies. Here is a portion of Kevin Dowd’s enlightening foreword to Mr. Sechrest impressive book.

Sincerely,

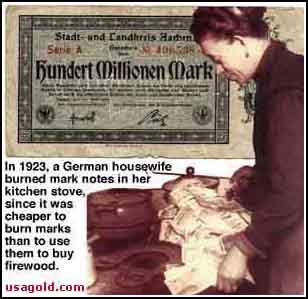

Free banking is—or at least ought to be—one of the key economic issues of our time. There is mounting evidence that the monetary instability created by the Federal Reserve—persistent and often erratic inflation, the unpredictable shifts of Federal Reserve monetary policy, and the gyrating interest rates that accompany both inflation and the monetary policy that creates it—have inflicted colossal damage on the U.S. economy and on the fabric of American society more generally. Furthermore, much as the United States has suffered, less fortunate countries have suffered far more. Most of us have watched in horror, for example, as Russia has come out of more than seventy years of Communist misery only to slide now into the abyss of hyperinflation. Unlike some disasters, monetary instability is entirely avoidable, but to avoid it, we need to make sure that the monetary system is built on the right foundations—foundations we are very far from having.

On top of these monetary problems, we also observe in the United States how ill-judged attempts to regulate the banking system and protect it from the (grossly exaggerated) danger of runs have spawned a massive apparatus of deposit insurance and regulatory control in the form of the FDIC, the now-bankrupt FSLIC, and a variety of other bureaucracies. These agencies were (ostensibly) set up to protect a banking system that, though weakened by legislative restrictions of various kinds and by misguided Federal Reserve policies in the 1930s, was still relatively strong, and yet they managed to convert that system into a chronic invalid made artificially dependent on the ultimately lethal drug of deposit insurance. In addition to gravely weakening the banking system and destroying much of it in the process, the deposit insurance system also accumulated staggering losses—losses of hundreds of billions of dollars and perhaps more—which it then passed back to the long-suffering federal taxpayer. Politicians and bureaucrats have responded with a series of largely cosmetic reforms that have accomplished virtually nothing and are nowhere near any realistic solution.

Once again, what we need are sound free-banking foundations. We do not have such foundations and are unlikely ever to get them if things continue as they are. Larry Sechrest’s book is therefore a timely contribution to a very important policy debate. It is sad indeed that our political and intellectual leaders have still to learn the most important and most obvious lesson to be drawn from the collapse of communism in the eastern bloc—that central planning does not, and cannot, work. To paraphrase Larry, amidst all the celebration that accompanied the demise of communism and with all that has been written about the problems of central planning, our leaders are still afflicted with the craving to practice it, and they cling to the illusion that though eastern bloc socialism might be dead, they still believe that all is well with central planning in the West. They know that central planning failed in the East, but they learned nothing from that failure, and nowhere is this illusion stronger and more cherished than in the sphere of money and banking.

One suspects that part of the reason the illusion is as strong as it is in this area is that even professional economists are by and large still afflicted with the central planning mentality. We do not talk of monetary central planning, of course—we talk of central banking or monetary policy—but the goals are the same even if we prefer to use a less sinister label to describe them. Central banking is central planning. Those of us who support free banking find it odd that despite all the failures of central planning—the failures of central planning in the eastern bloc, the failures of monetary central planning in the West, and other failures besides—so many economists still cling to it and refuse to consider free banking as a serious alternative.