Thomas Woods – Meltdown

The Austrian business-cycle theory is the missing factor in today’s economic discussions. It connects the dots on so many seemingly disparate data points and explains systematically what everyone else is treating as isolated events. Unfortunately, the business-cycle theory is rarely discussed and almost never truly understood by today’s talking heads.

The Austrian School of economics is the only school that has developed a working model of how savings and investment needs work together to create the natural rate of interest. No where is there a need for the central banks Statist central planning interventions to artificially lower the interest rates.

This, in fact, is why the theory is kept from mainstream discussions because it places the blame for the Global Financial Crisis where it belongs, namely, on the State’s partnership with the central banks to run the banking system cartel. The banking cartel is designed to protect the fraudulent fractional reserve banking system from collapsing upon itself.

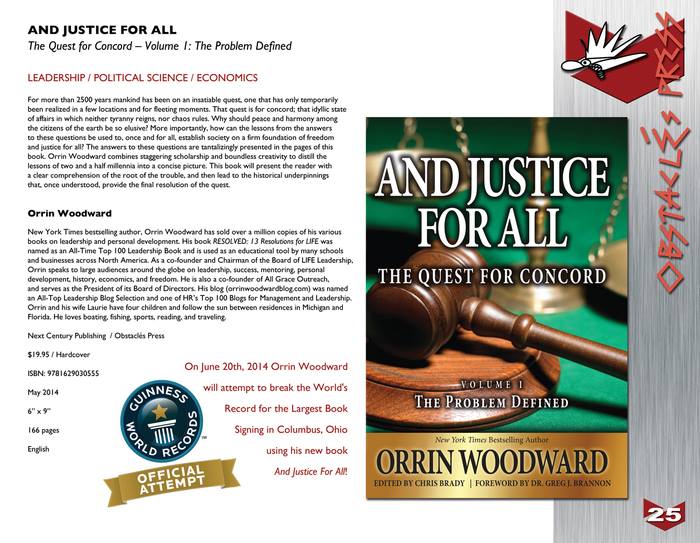

LIFE Leadership is set to release the first of my planned three book series on society and the State titled And Justice for All. The book will be available at the June Columbus major function. In the book, I describe how the State intervenes within society, allegedly to serve the populace, but actually to increase its power. I go on to describe how these State interventions affect society.

Justice for all is the goal of every righteous society, but the government must be restrained to perform only its intended functions to accomplish the assignment. Who guards the guardians? This ought to be the question asked by all concerned citizens to ensure the destructive Five Laws of Decline do not destroy the productive Six Duties of Society.

Here is a brief summary on the business-cycle and Thomas Woods excellent book Meltdown from the Mises Institute. I highly encourage everyone to read this book as it is the best simple description of the business-cycle theory.

Sincerely,

Orrin Woodward – LIFE Leadership’s Chairman of the Board

Austrian business-cycle theory is straightforward, for those willing to devote the necessary time to study praxeology. But therein lies a problem. The average person lacks the patience to read Human Action and Man, Economy, and State. How then can he acquire the rudiments of Austrian cycle theory and grasp why the theory is true? To set the question aside, on the grounds that it is unnecessary for the man in the street to bother with such matters, is a counsel of despair. If the public does not understand the economics of depression, there is little hope that we can avoid disastrous government policies. Unless the free market receives sufficient popular support, our economic future is bleak.

Woods supplies just what we need. With great clarity, he shows that the Austrian theory of the cycle is firmly grounded in common sense. Additionally — and here his skill as a trained historian comes to the fore — he shows that Austrian theory explains not only the Great Depression but other less-well-known economic downturns as well. When the government followed a “hands-off” policy, recovery from a downturn was rapid; when, as most notably was the case in the New Deal, government tried to take control, the economy sputtered.

The basics of Austrian cycle theory fall readily into place once one considers a fundamental point: the economy can grow only by producing more goods. An expansion of the money supply does not suffice. Efforts to get something for nothing, by the government’s deficit spending or by an expansion of the money supply, cannot produce lasting prosperity.

The speed with which an economy grows depends on the extent to which people prefer present goods to future goods. Other things being equal, people always prefer satisfaction in the present; but the extent to which this preference prevails is crucial for economic development. In order to obtain more consumer goods than are immediately available, people must postpone satisfaction by saving, enabling a greater production of capital goods to occur.

Look at it from the saver’s perspective. Saving more indicates a relatively lower desire to consume in the present. This is another incentive for businesses to invest in the future, to carry out time-consuming investment projects with an eye to future production, rather than produce and sell things now. (p. 67)

The extent that they are willing to do so determines the rate of economic growth.

The preference people have for the present forms the main part of the rate of interest: Mises called this the originary rate of interest. This rate registers the way people allocate resources between consumption and production.

Trouble arises when the government, by increasing the supply of bank credit, depresses the money rate of interest below the natural rate. Businessmen, seeing that money is available, invest in capital-goods industries, and the result is a boom.

Once the monetary expansion stops, the boom cannot be sustained. The entrepreneurs who expanded their production of capital goods need more money to sustain their projects, but not enough is available at an interest rate that will secure for them a positive return. In the absence of monetary expansion, the rate of interest rises, since time preference has not changed (or at least there is no reason to assume it has.) At the higher rate of interest that now prevails, formerly profitable enterprises now have to be liquidated. This process of liquidation is precisely the depression.