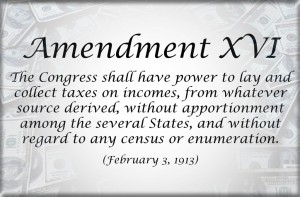

I am still plugging along on my new book. The long history of taxation has been both a treat and disappointment to me. On one side, it has been a treat to learn all the various methods that society has sought to check the exploitive State. On the other side, though, it has also been disappointing to realize how many times the State has won this contest against society. LIFE Leadership is a company on a quest to learn truth so it can be shared with others. The only agenda is truth, wherever that may lead in life. Understanding taxation is an important aspect of State/Society truth. More pointedly, understanding the Income Tax, that goose that has laid so many golden eggs for the State at society’s expense is essential. There are few areas in the history of mankind that have been subjected to more Five Laws of Decline outcomes than the taxation policies. Hence, let’s turn to the Income Tax in today’s blog.

Sincerely,

Orrin Woodward

USA Income Tax Amendment

Income tax has proven to be the goose that lays the golden eggs for government. Although all governments, even those performing its limited and delegated role, need constant funding, the creation of income tax has led to the unlimited State. Indeed, expecting a limited-government to restrain itself when it has been handed the power to tax the people’s income indiscriminately is like expecting the local drunkard to restrain his drinking when he has a free pass for unlimited drinks from the local brewery. It cannot be emphasized enough that power is an insatiable drug and money is its means of purchase. Hence, any government given a practical unlimited ability to tax (restrained only by society’s rebellion or destruction) will use this power over the purse to build State Power by taxing Social Power. The State’s view of society is akin to a the shepherd over his sheep, namely, seeking to shear them as close as possible without slaughtering them. Montesquieu recognized the State and Social Power and Social symbiotic relationship when he wrote:

The revenues of the state are a portion of that each subject gives of his property in order to secure or to have agreeable enjoyment of the remainder. To fix these revenues in a proper manner, regard should be had both to the necessities of the state and those of the subject. The real wants of the people ought never to give way to the imaginary wants of the state. Imaginary wants are those which flow from the passions, and from the weakness of the governors, from the charms of an extraordinary project, from the distempered desire of vain glory and from a certain impotency of mind incapable of withstanding the attacks of fancy. Often has it happened that minsters of a restless disposition, have imagined that the wants of the state were those of their own little ignoble souls.

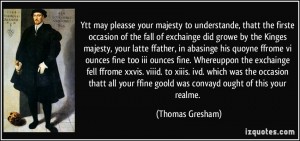

The State and society, however, have had an ongoing dispute over the definition appropriate, equitable, and just levels of taxation. Indeed, when John Marshall wrote, “the power to tax is the power to destroy”, he articulated why limiting government’s ability to tax is just as important as limiting as its sphere of operation. In fact, the only proven method for limiting the State has been by limiting its funds. For anytime the funds are available to do so, government’s “force hammer,” has routinely usurped its delegated boundary to becomes the exploiters agent of injustice. Accordingly, if society intends to enjoy its inalienable rights, it must minimize the level of taxation to a limited and equitable amount that permits the government to perform its delegated role. Anything above this minimum amount is dangerous to the inalienable rights of society’s members since government will seek to use these funds to interfere with the SDS. Unhappily, few societies have successfully walked this tightrope and thus why the FLD has historically thrived under government taxation schemes. Taxation has typically been used by the rulers to optimize their profits and power by providing special deals for the few funded by increased taxation upon the many. Tax historian Charles Adams wrote:

A government that taxes excessively is like a spouse that engages in adultery. Its destructiveness is usually not apparent until it is too late. . . A society can best be evaluated by examining who is taxed, what is taxed, and how taxes are assessed, collected, and spent. Those in control of the political process invariably bear lighter tax burdens than those on the outside. . . Taxes are forced exactions. The loss of money through taxation often enrages people and drives them to revolt. Governments, therefore, must face their tax management with the utmost prudence and wisdom. . . A government that shackles its people with grossly inequitable tax laws and despotic enforcement practices loses all moral persuasion with respect to compliance, and can hardly complain if its taxpayers resort to all kinds of schemes to protect themselves . . . The ethics then, of society’s tax policy should develop from two moral maxims: First, it is the duty – the first duty – of every government to develop just and sound revenue systems. . . Second, it is the duty of every person to pay his (or her) fair share of the costs of maintaining the government that serves and protects them.

Regrettably, the history of taxation reveals the inability of those in power to lightly shear society’s sheep. As the tax rates increase, the shearing transforms into slaughter as the the people are plundered mercilessly. Moreover, the increased taxes rob the people of the capital needed to grow the SDS. As a result, societal growth slows before it begins its inevitable decline. Although people can endure injustices for extended periods of time, they will not tolerate an unjust tax system indefinitely. If the FLD continues to expand within the tax system, then evasion, exile, and rebellion become the potential paths of action. But when the rebellion against the State’s oppression reaches a certain point, the SDS collapses as either chaos or coercion overthrows societal concord.