Perhaps the best way to explain fractional-reserve banking is by analogy. Just as a bank note was originally a metaphysical paper representation of a specific physical amount of precious metal money so too is a property title a metaphysical paper representation of a physical plot of land. Imagine the indignation a person would feel if he had exchanged his money for the title believing he had purchased a plot of land only to discover later that the unethical seller had copied the title and sold the paper title to ten other people. What was actually sold? Eleven people cannot own the same physical piece of land but they can own identical metaphysical paper representations of the land. The fraud, as a result, begins the moment the metaphysical representation no longer matches the physical reality. Legally, the seller is guilty of violating property laws and would face severe sanctions for his crime.

Curiously, however, when a bank behaves in a similar fashion and prints numerous banknotes representing titles to the same specific physical precious metals money, it is not considered a violation of property laws. Paradoxically, the same fraudulent behavior where multiple metaphysical copies a one physical item receives severe penalties in every other area, somehow is considered “legal” practices in banking and is termed fractional-reserve banking (FRB). For how can the same physical precious metals be sold (loaned) to numerous parties via its metaphysical paper representation anymore than the same physical land can be sold to numerous parties using the identical scheme? How, in essence, can several parties own the same property at the same time? The answer is a physical impossibility and a metaphysical fraud.

Another example conveying the injustice of FRB is to picture a person who decides to sell his motorcycle. He places an ad in the paper and receives a call with a strange request. The potential buyer states his wife is against him owning a bike, but he really wants one. He offers to purchase the bike if the seller will store the motorbike in his garage. The buyer will only use the bike on Saturdays and he even offers to pay a small storage fee. The seller agrees and the title is exchanged for the cash. After several months, the seller realizes the bike is just sitting there the other six days. At first, he casually takes the bike for a ride personally, realizing he practically owns the bike even though he sold it and receives a monthly fee to store it. Finally, however, he conceptualizes and even more devious plan. Why, he asks himself, not copy the title for the bike six more times (since there is seven days in the week and the “owner” needs his bike only one of the days) and sell the bike again to other unsuspecting “owners”? Not only would I seven times my profit but I would also be able to charge a storage fee to each “owner”.

The fraudulent seller proceeds to run the motorcycle ad specifically looking for husbands with limited time and protective wives. To the seller’s delight, over the next several months he identified six more buyers. The seller was careful to only select buyers who asked to store the bike and who only desired to use the bike on a specific day. Although each person believed he owned the motorcycle in full, the seller defrauded all of them for his illicit gains. Now, the storage owner had a new “owner” for each day of the week and received seven times the profit on the sale of his bike and still received storage fees on top of that! Is this fraud or an innovative fractional-reserve motorcycle selling system?

True, if each owner knew he was only buying one day’s ownership then its physically possible and metaphysically permissible because the titles would represent only a fraction of ownership. This, however, wasn’t true in this case nor is it true with FRB loans. Each owner believes he owns 100% of the bike title and paid for it in full. Accordingly, the seller has committed fraud by metaphysically representing he had seven bikes to sell even though he actually owned only one physically. The pragmatic argument that since the bike owners were not using their property the other six days of the week that the storage facility had a right to sell someone’s else’s property the other six days is simply ludicrous. Especially when the owner’s property was sold without his knowledge or consent.

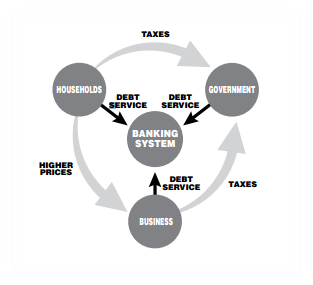

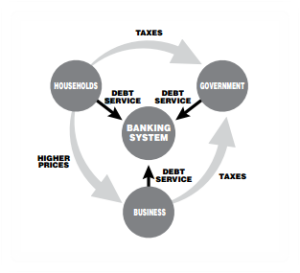

The banks, however, systematically practice the same thing. For instead of storing society’s money (like most people believe they do) they actually sell (loan) the owner’s money to numerous third parties while acting like the money is available to the original owner on demand. How can the same money be loaned out to ten separate parties while still being available to the actual owners all at the same time? This simply is not possible in the physical world but as shown above it is possible when practicing a metaphysical fraud. Amazingly, the motorcycle seller’s fraud would be punished severely, but the bankers similar fraud is blessed by the State.

The Bank of England (one of the first central banks) utilized FRB to print over ten times as many banknotes as the actual precious metals stored in England’s vaults. As a result, the Bank of England quickly captured the English Empire’s money supply and called the shots as Master of the Puppets. However, the issuance of paper bank notes led to one further innovation in money creation that, strangely enough, was developed in colonial America, namely State fiat-paper. Colonial America lacked precious metal money and did not like the control the Bank of England had on colonial commerce. Naturally, the question was asked, why not have the colonies issue their own paper notes and promise to redeem them with future tax revenues? In this way the government, businesses, and individuals would not have to pay the Bank of England interest on their paper notes.

The new Sovereign State backed money was a huge success (its still Fiat Money and has its problems but at least the public State does not pay interest to private international financiers) in usurping the need for the Bank of England notes. In fact, Ben Franklin was so impressed by the new innovation that he wrote a treatise in defense of the public Sovereign State backed paper money. Of course, the international bankers who controlled the Bank of England were not amused with the colonial upstarts cheekiness. The Bank of England restored its profits by applying pressure to King George III who forced the colonies to shutdown the colonial paper and return to the Bank of England notes. This, in reality, and not the infinitesimal taxes on colonial merchandise was the real cause of the American Revolution. No less an authority than Ben Franklin himself (considered by many, including me, to be the greatest diplomat in American history because of his keen understanding of humanity) believed this when he observed, “The Colonies would gladly have borne the little tax on tea and other matters had it not been the poverty caused by the bad influence of the English bankers on the Parliament, which has caused in the Colonies hatred of England and the Revolutionary War.”

The new Sovereign State backed money was a huge success (its still Fiat Money and has its problems but at least the public State does not pay interest to private international financiers) in usurping the need for the Bank of England notes. In fact, Ben Franklin was so impressed by the new innovation that he wrote a treatise in defense of the public Sovereign State backed paper money. Of course, the international bankers who controlled the Bank of England were not amused with the colonial upstarts cheekiness. The Bank of England restored its profits by applying pressure to King George III who forced the colonies to shutdown the colonial paper and return to the Bank of England notes. This, in reality, and not the infinitesimal taxes on colonial merchandise was the real cause of the American Revolution. No less an authority than Ben Franklin himself (considered by many, including me, to be the greatest diplomat in American history because of his keen understanding of humanity) believed this when he observed, “The Colonies would gladly have borne the little tax on tea and other matters had it not been the poverty caused by the bad influence of the English bankers on the Parliament, which has caused in the Colonies hatred of England and the Revolutionary War.”

In closing, one of the best principles I learned from economist Dr. Murray Rothbard was FTM – Follow the Money. For every one person motivated by ideals, there are a thousand who are bought and sold. Unfortunately, the more history I read with an eye on Cui Bono (who benefits) the more I realize that most of the history I thought I had learned is simply not so. LIFE Leadership is a company designed to help people learn the truth, escape The Financial Matrix, and live a life that matter. I promise to play my part and continue my quest for truth by helping the people understand the dangers of enslaving themselves body, mind, and spirit into the matrix.

Sincerely,